The Startup Reading Deck: Your Blueprint for Communicating Business Viability

Illuminate your business for stakeholders.

Behavioral science principles like prioritizing information, using simple language, and leveraging insights like social proof can enhance writing for busy readers and stakeholders, as Todd Rogers, co-author of "Writing for Busy Readers," highlighted in a recent Irrational Labs member webinar. Applying these insights allows you to craft more effective communications tailored to your stakeholders' perspectives and needs. I was inspired when I heard Todd speak about leveraging behavioral science to improve writing for busy readers. It can help as you craft communications like the startup reading deck to reach your busy startup stakeholders effectively.

Check out the Behavioral Economics Bootcamp from Irrational Labs to integrate proven methods and frameworks to increase customer engagement and behavior change through product design. Innovate & Thrive subscribers receive a special discount: Insert code "DrJack" for $50 off!

Introduction

No idea or company attracts resources to help it grow unless the entrepreneur can communicate the opportunity clearly to potential stakeholders, whether they are investors, bank loan officers, corporate partners, acquirers, suppliers, or employees. Over the years, I have worked with thousands of startup founders and teams and have honed in on a suite of materials that can support the need to communicate with multiple stakeholders. This post will review the foundational document for all stakeholder materials, the "Reading Deck."

Business Plan Documents for Various Stakeholders

There is no one way to write a business plan and many ways to prepare and write a business plan. Therefore, entrepreneurs will find it necessary to research many areas before they have enough information to start developing comprehensive planning documents.

A suggested business plan package includes four documents: (1) Detailed business plan or "Reading" slide deck that provides a comprehensive view of your business model and execution plan. This investor-ready–"branded" document should include extensive customer, market, and industry research along with your experience to date with product development and testing, (2) 36-month Financial Statements including detailed assumptions, (3) a 1–2-page Executive Summary Document covering critical points on your opportunity, target customer, market size and industry growth trends, competitive analysis and strategy, product offering and value proposition, financial highlights and capital requirements, and team profile, and (4) Venture pitch deck deliverable in short timeframes, usually 8-12 slides in length.

The "Reading Deck" is a platform for building many documents that address various stakeholders' interests.

Identifying and preparing to deal with multiple "interest groups" throughout your venture realization journey is essential. Each stakeholder group wants to hear something from your story that provides a comfort factor related to their interests and goals. For example, investors want to know the risk/reward "formula" and the future "cash-out/cash-in" possibilities associated with your new venture. Employees want to feel secure knowing they have a job with your company and a possible career. Marketers must understand the product/service, pricing, placement, and positioning (the four Ps). Vendors, suppliers, and associates need to know what your operations will look like so that they can plan to be part of your supply chain. Finally, partners (if any) need to codify their legal and fiduciary rights and responsibilities for their protection and growth.

Founders must communicate their ideas in a structured manner, providing a roadmap to where the business is going and how it plans to get there. This roadmap must accomplish this professionally and concisely.

1. Business Plan Reading Deck

Savvy entrepreneurs recognize the value of a business plan for securing capital and growing their businesses. Business plans are a mode of communication between entrepreneurs and potential investors. In addition, entrepreneurs often find that developing a business plan forces them to introduce discipline and a logical thought process into their planning activities. A properly prepared business plan will help entrepreneurs consistently establish and meet goals and objectives for their employees, investors, and management.

Business plans have historically been necessary for most entrepreneurs, especially those seeking financing. However, the definition of a business plan has changed recently. For entrepreneurs today, it can mean a traditional or complete plan with detailed marketing, financing, and operations content to a few pages showing where and how markets apply to the business. In addition, it is standard for today's startup founders to prepare a "Reading" slide deck. These decks are generated through presentation software and usually consist of 20–40 slides. These more extended reading decks are not for "pitching," as they are way too long and detailed for presentation purposes. However, it is common for entrepreneurs to select specific slides from the reading deck to prepare for shorter pitch presentations, commonly no more than 5–10 slides, pending the timing allowed.

The "reading" deck has replaced the traditional narrative-based business plan document. This change might seem like less work, but it takes a reasonable amount of time to create a concise version of your business model and structure it in a way that tells your story effectively. I find it helpful to use a structured framework to support the development of this reading deck. We go through the eight new venture realization roadmap modules when advising founders. Each module aligns well with the essential elements of a startup business plan. Modules 1-2 provide the starting point where founders describe the opportunity they hope to capitalize on with their venture.

New Venture Realization Roadmap: Fresh Perspectives & Insights

Introduction In this post, I want to update our readers and subscribers on the ever-evolving process of new venture realization. My focus continues to evolve over the years to encompass new theories and practices regarding the creation and growth of new ventures.

Additionally, they can use the business model canvas as an integral part of the planning document, weaving the nine elements throughout the plan's sections. Modules 3-4 focus on extensive customer discovery and marketplace analysis, covering what you know about customer needs, the number of customers looking for a solution, existing solutions, and other significant marketplace trends and stakeholders. Module 5 provides the opportunity to describe the status of your product's development and testing with customers. Module 6 guides you through customer acquisition and branding strategies. Module 7 is all about finance, helping founders build credible financial projections and identify critical metrics in their startup's development. Finally, Module 8 highlights key operational and human resource management vital to execution and startup launch. With this in mind, let's review the main components of a business plan reading deck.

2. Compiling Market Research Findings

2.1 Starting with the Opportunity

An excellent place to begin is to describe the opportunity you hope to solve for the customers. What does the customer need, and why can they not meet them? This section should describe the customer experiencing the problem the most, the context of the experience, and articulate what key behaviors will facilitate desired outcomes. I suggest that you use the opportunity statement template to support your thinking at this point.

Then, a brief description of how the venture plans to solve the customers' problem highlights the proposed product offering, its benefits, and overall value to the customer. These early slides should give insight into what stage the company has reached. Is it a seed-stage company without a fully developed product line? Has it developed a product line but not yet begun to market it? Or is it already selling its products and anxious to expand its scale of activity? It is essential to be transparent about the status of your startup development.

Another slide to add to the opportunity section allows the founder to document early pre-screening of the marketplace. I find that many new entrepreneurs come into an idea with minimal understanding of the dynamics of the industry and associated ecosystem. What are the major industry trends? Is it growing, segmenting, or declining? Who are the leading domain experts, thought leaders, and influencers? Who should you be following on social media, reading their writings, and potentially connecting with them at some point in the venture's development? Finally, founders should take an early survey of the competing solutions in the marketplace. This information helps founders evaluate the market's attractiveness and the nature of the current activity to solve the customers' needs.

2.2 Customer Discovery Data and Findings

The market analysis section should focus on customer discovery, market size, growth trends, and the competitive landscape. The market research section documents what you learned through primary and secondary research. What you have learned via direct customer engagement is the most valuable data from primary market research. This information is the best evidence that your venture offers a product that customers need and will buy from the company. Stakeholders such as bankers and investors like to talk to potential customers when undertaking due diligence, and positive responses go a long way to establishing confidence in the business.

Some of the most critical issues to address in the market research analysis section include the following:

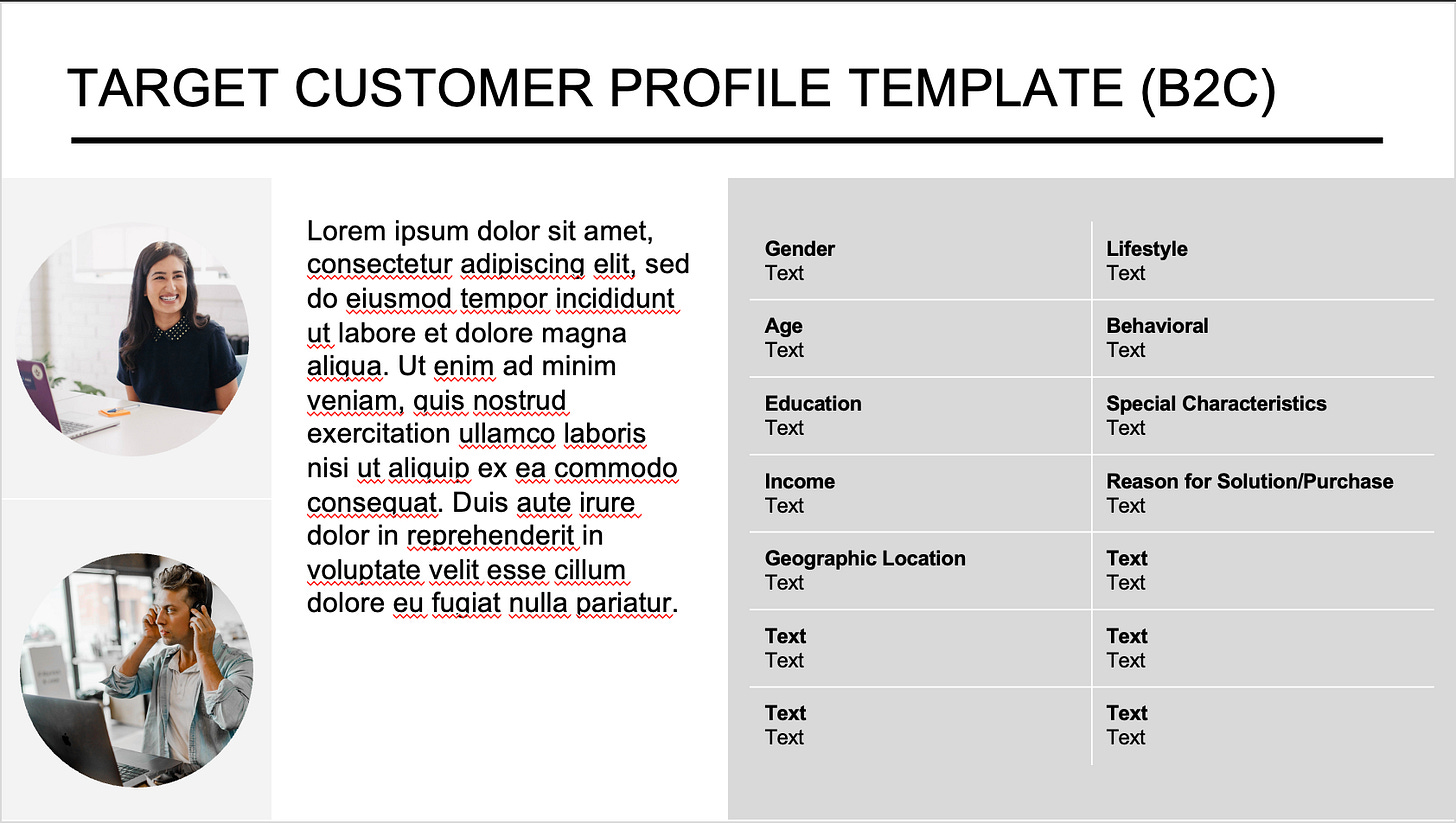

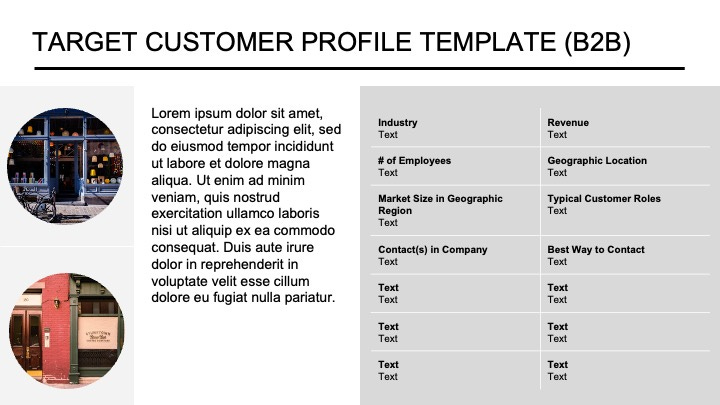

Customer Discovery Data and Findings. In this portion of the plan, you begin with a clear definition of your target customer. Here, you can present the profile of your customer base, listing important demographic and behavioral characteristics of your beachhead customers. Additionally, I suggest that you add a customer persona to go with the demographic data. A persona effectively shares your customer's story, needs, obstacles, and desired outcomes with all stakeholders.

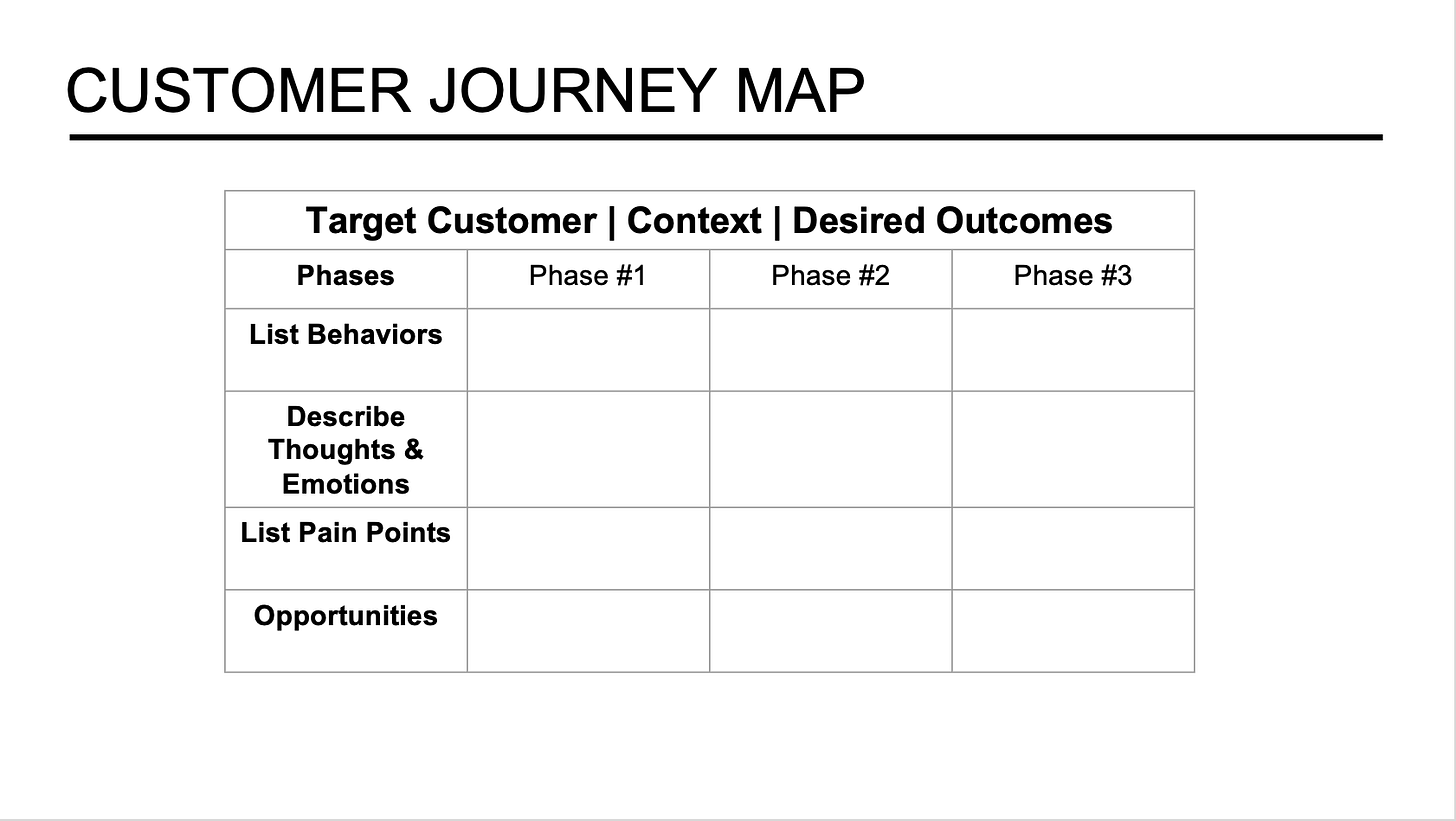

To compliment your customer persona, I suggest including a pre-solution journey map. Visualizing what your customer is experiencing before your solution's existence highlights their pain points in the current marketplace. In addition, mapping their journey adds clarity to your target customer's needs and desired outcomes, thus providing additional clarity to all stakeholders.

A final slide in this section focuses on what you have learned from your customer discovery interviews and surveys. You should include the number of customers and any relevant target demographic data. The slide should highlight critical findings that validate or invalidate your early assumptions about the target customer, the presenting opportunity, pain points, and desired outcomes. You can list your premises and provide an ✓or X validation status.

Unleashing Value through Customer Discovery: A Comprehensive Guide for Startups

Introduction Innovation has become a driving force in today's rapidly evolving business landscape. To stay competitive, companies need to constantly develop new products, services, and processes that meet their customers' ever-changing needs and preferences. However, embarking on innovation without a solid foundation is like building a house on shifting sands. That's where customer discovery comes in.

2.3 Market Opportunity

The marketing section must establish a demand or need for the product or service and define both the market and the potential opportunity. Many founders apply a framework that defines the total available market (TAM), served available market (SAM), and share of the market (SOM). I recommend conducting a bottoms-up analysis only on your target customer (beachhead). In this scenario, the TAM estimates how many target customers, as defined by your profile, exist within your geographic boundary. SAM further delineates your market by customers actively searching for a solution to said problem. Finally, SOM estimates how many of those SAM customers you can reach and acquire in the first 1-3 years of operation. You refine your SOM estimations once you have a customer acquisition strategy and understand operational constraints.

The Power Duo: The Interplay Between Customer Segmentation and Market Sizing

Accurately sizing the total addressable market is crucial yet challenging for new ventures. As an alumnus of Irrational Labs' Behavioral Economics Bootcamp, I learned firsthand how cognitive biases shape our market judgments and decisions. Founders can counteract bias by leveraging objective data, evaluating assumptions, and continuously revising. My key takeaway is that mental shortcuts can profoundly skew perceptions if unchecked. However, we can conduct a balanced market analysis with intentional strategies to determine reliable size estimations.

2.4 Competitive Positioning & Marketplace Trends

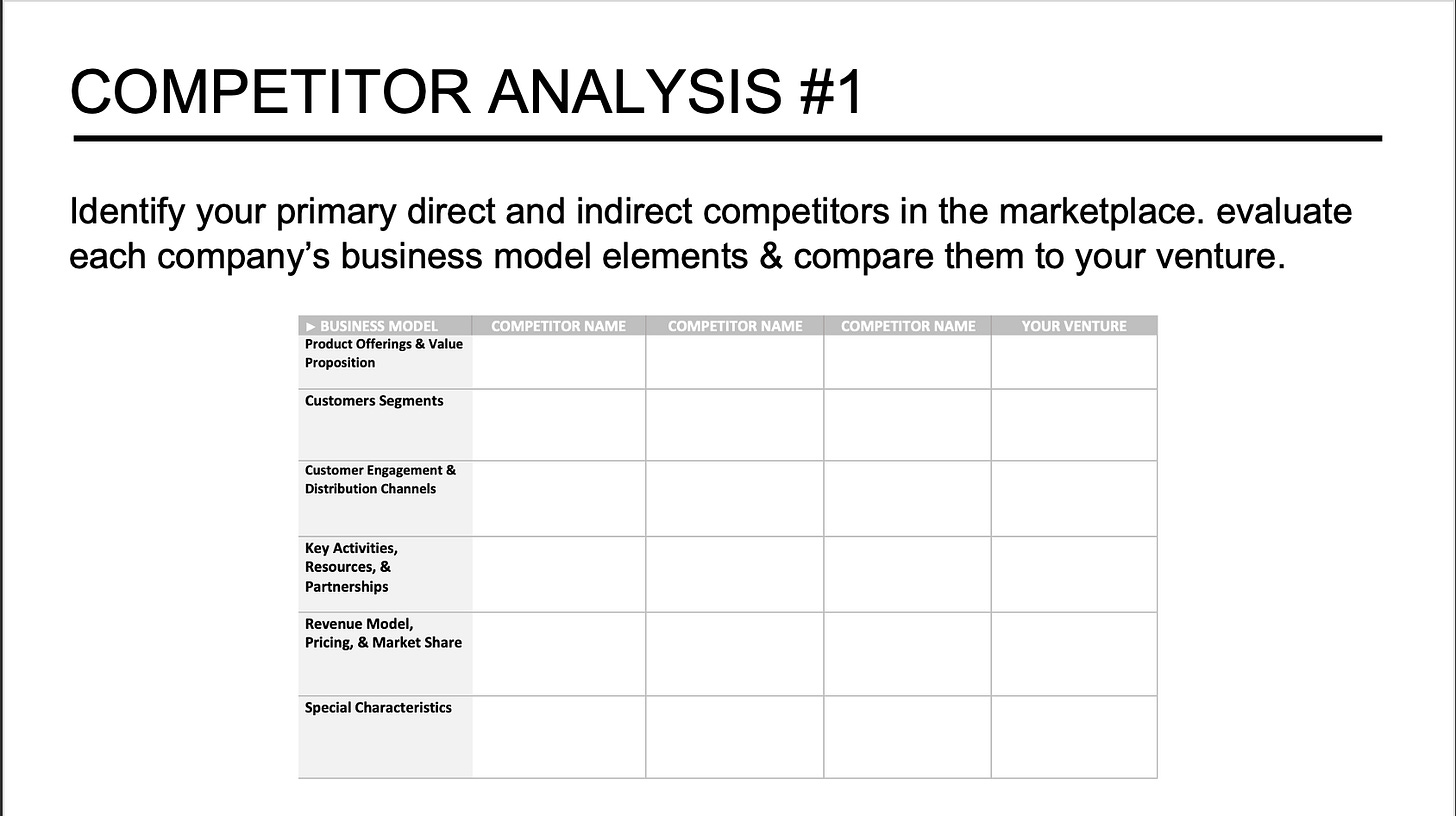

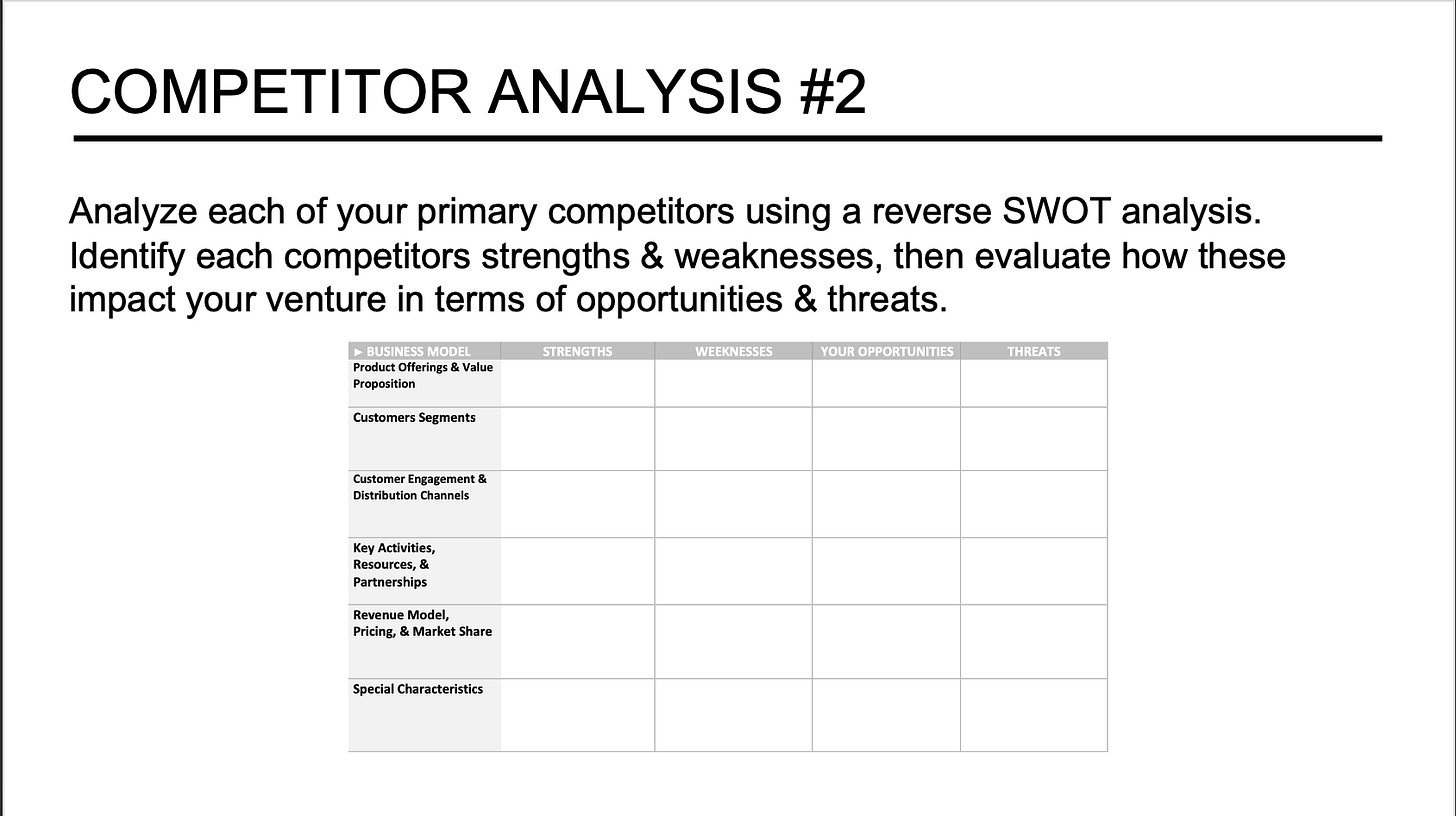

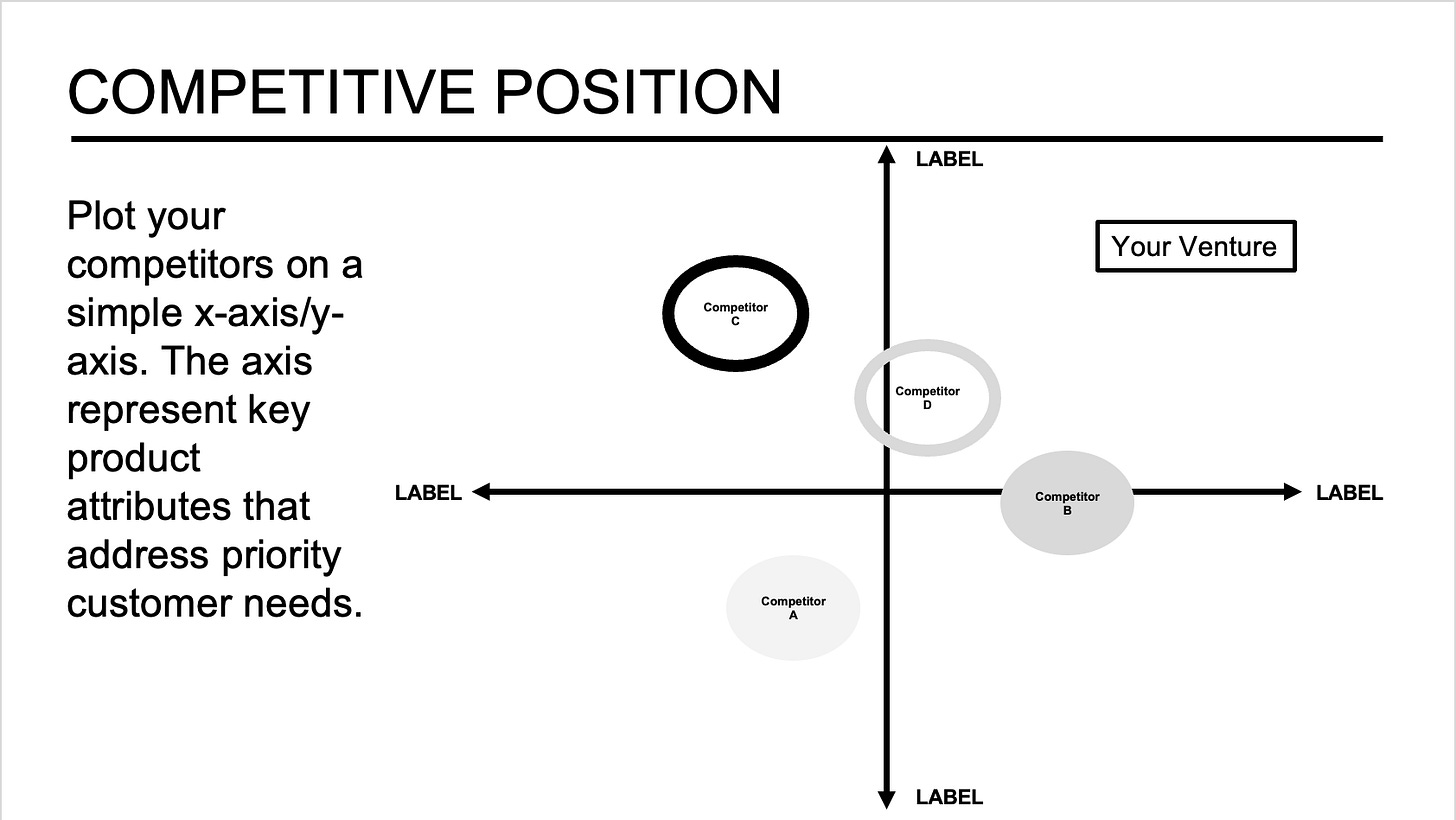

The market research section should describe the conditions in the business, including the degree of competition and what impact this competition will likely have on the company. Addressing other forces, such as government regulations and outside influences, is also essential. To support the development of your competitive strategy, you first identify your primary competitors and then analyze their strengths and weaknesses. The first step of the analysis is to investigate the business model elements of each competitor and compare the results to your venture's model. The second step is to conduct a reverse SWOT analysis to determine each competitor's strengths and weaknesses and translate these findings into potential opportunities and threats to your venture. This type of analysis leads to your market entry strategy.

One way to illustrate the current competitive landscape and your strategy to enter the market is through what is called a positioning graph. Typically, founders select essential product attributes that address vital customer concerns. The rationale for choosing said attributes is that the founder believes the selected characteristics set them apart from the competition.

Mastering Competitive Analysis: A Step-by-Step Approach for Entrepreneurs & Innovators

Introduction Studying your competition is an ongoing pursuit in the entrepreneurial context. It is not something you do sporadically. You identify and monitor all significant and emerging competitors throughout the venture realization process. You determine their strengths and weaknesses and consider how they will react to every one of your strategic moves. What some call competitive intelligence will be an ongoing process for you as an entrepreneur and business owner.

In conjunction with the competitive analysis, you may add a slide focusing on important industry and marketplace trends. Stakeholders are interested in the status of the industry. Founders share compound annual growth rates with investors regarding their return goals. However, it is essential to identify any political, economic, social, technological, legal, or environmental trends that may impact your venture's success. In the background, conducting a PESTLE analysis and highlighting them in your reading deck is vital.

Market Analysis for Startups: A Founder's Guide to Industry and Ecosystem Evaluation

Introduction Market research and analysis are indispensable for startup success and growth. This article explores two robust frameworks entrepreneurs can leverage to gain strategic insights into their target market's dynamics and ecosystem: industry analysis and startup ecosystem analysis. We will examine key elements of conducting industry analysis, including identifying your industry classification, researching historical trends and growth patterns, monitoring technological changes, analyzing the competitive landscape, and identifying influencers. We will also look at components of assessing your surrounding startup ecosystem, such as advisor and mentor networks, funding sources, infrastructure support, and talent pools. With insights from both frameworks, founders can make informed decisions and craft data-driven strategies tailored to capitalize on high-potential opportunities in their marketplace. The knowledge gained will equip entrepreneurs to navigate uncertainties on their journey adeptly.

3. Sharing Product Status

The products section of the business plan describes the characteristics and appeal of the products or services. This section should describe the offering well and what benefits and value it will provide to the target customer. Additionally, product benefits are prioritized and linked to specific features that demonstrate how the product functions to create said value. The section should also include the following:

Benefits & Features: The entrepreneur should comment on the nature of the product or the service's various uses and what constitutes its appeal. This section is an opportunity to emphasize the unique features of the product or service and the value proposition to customers, thereby establishing the business's potential.

Description: A description of the physical or digital characteristics of a product usually includes photographs, drawings, wireframes, or brochures. In the case of a service, a diagram sometimes helps to convey what service the business is providing.

Stage of Development: This is a description of the stage of development (prototype design, quality testing, implementation, and so on) of the product or service that the entrepreneur plans to introduce into the marketplace.

Early Customer Feedback: Entrepreneurs can include comments from earlier customers who have been part of the product testing process. Additional customer data, such as survey results and further comments, can be added in the appendix section of your reading deck.

As part of the product section of the business plan, the entrepreneur should provide a detailed development plan related to the product, its development and testing iterations, and market entry dates. Creating this part of the plan allows entrepreneurs to illustrate the stages and timing of their product efforts, including any capital required.

Depending on the type of business, the entrepreneur may want to discuss the product production and maintenance plans. It is essential to discuss how a company will produce its products. Production can involve third-party producers or some description of the plant, equipment, material, and labor requirements. The plan should address the company's level of support after a customer purchases a product or service.

Driving Startup Growth: Harnessing Early Product Design and Testing

Introduction In this article, I delve into the strategies and approaches for early product design and testing within the startup context. While the focus is on startups, it's important to note that many of the practices and tools highlighted can be applied across various settings, from small ventures to large corporations and different product categories, catering to both B2C and B2B markets. The critical emphasis is customer engagement and establishing long-term relationships with early target customers. By approaching product design and testing as part of the customer discovery process, startups can validate assumptions, learn about customer needs, and build rapport with their initial contacts, paving the way for early traction and customer advocacy.

4. Describing Marketing Strategies & Promotional Activities

The marketing and sales strategy section describes how the business will implement the marketing plan to achieve expected sales performance. This analysis will guide the entrepreneur in establishing pricing, distribution, and promotional strategies to make the company profitable within a competitive environment. Founders should highlight a few elements in this section at this stage.

I encourage founders to use some marketing mix framework, such as the 4Ps - product price, promotion, and placement. Please start with a precise product positioning statement highlighting the customer problem, how you solve it, significant benefits, what differs from existing solutions, and what competencies your team has to solve the problem. You want to make a compelling case to all stakeholders that your venture's product is the best option.

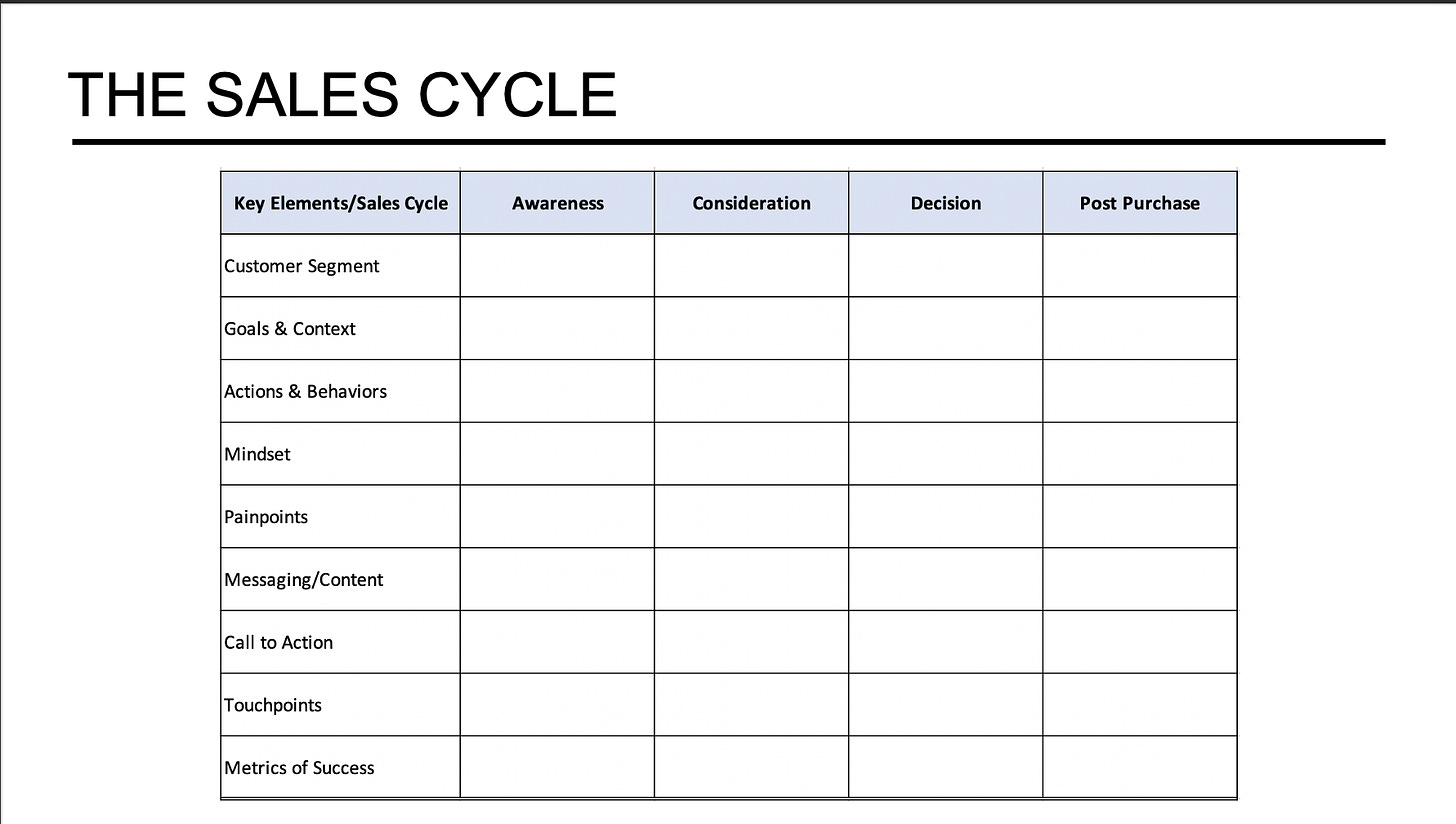

Then, you can highlight how pricing, promotional activities, and placement channels support your product positioning. Pricing is essential in marketing because it directly impacts the business's success. The reading deck's marketing and sales strategy section should address policies regarding discounting and price changes and their impact on gross profit (revenue less cost of goods sold). When considering what price to charge, it is essential to realize that price should not be based entirely on cost plus some profit. Instead, consider various pricing methods and strategies to generate the necessary profits for the business. You must align your placement strategies with both your pricing and promotional strategy. Ensure to highlight the primary placement channels you will use to reach your customer throughout the sales cycle - from initial awareness to post-purchase service.

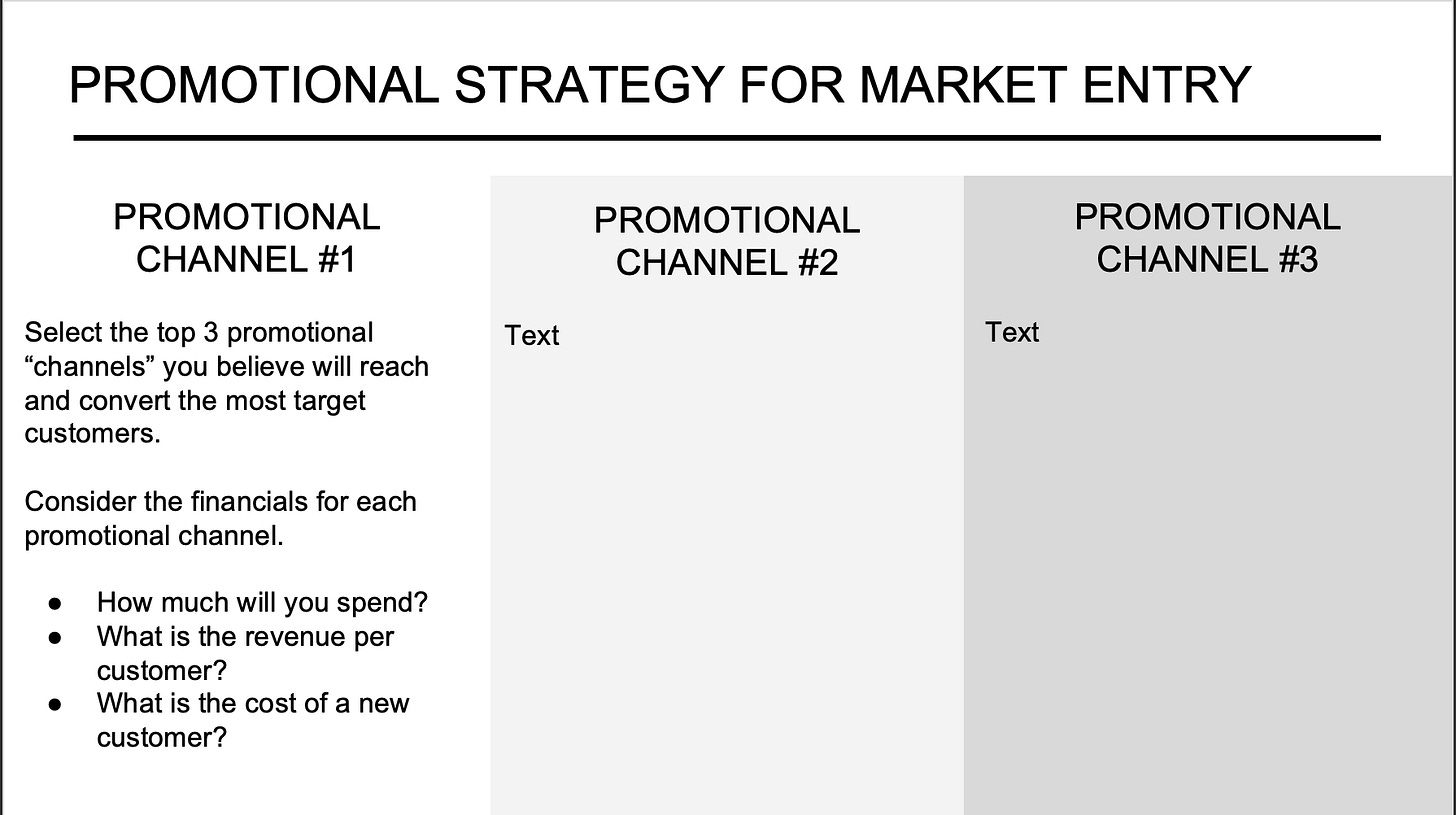

Finally, you want to describe how you will tell potential customers that you have a product or service that can satisfy their demands, convince those customers to buy from you, and successfully compete with similar businesses. One cannot emphasize the importance of explaining your strategy to move the customer through the sales funnel and what drivers are in place to convert leads into paying customers. At this point, I suggest that founders focus on three priority promotional activities and explain the sales funnel calculations for each channel. In other words, clarify how you will drive early customer engagement and revenues and the cost implications for customer acquisition.

Startup Growth: How to Attract and Retain Customers Through Your Marketing Mix

Introduction Attracting and acquiring the correct number of customers is a significant challenge for startups and a vital element for the survival and growth of any new venture. Successful customer acquisition requires carefully aligning several components of the business model, especially in the realms of customer relations and channel strategies. In this post, we will explore how startups can optimize customer engagement by ensuring that their marketing, sales, channel strategies, and customer service are all harmonious.

5. Detailing the Financial Plan

The financial plan section of the business plan should formulate a credible, comprehensive set of projections reflecting the business's anticipated financial performance. If these projections are carefully prepared and convincingly supported, they become one of the most critical yardsticks by which one measures the business's attractiveness. While the overall business plan communicates a basic understanding of the company's nature, projected financial performance directly addresses bottom-line interests. This information lets stakeholders discover the return on investment, performance measures, and exit plans. This reading deck section should not contain every line item in the financial pro forma; these details should be in the appendix. Judicial use of charts and graphs can make this section easier to read.

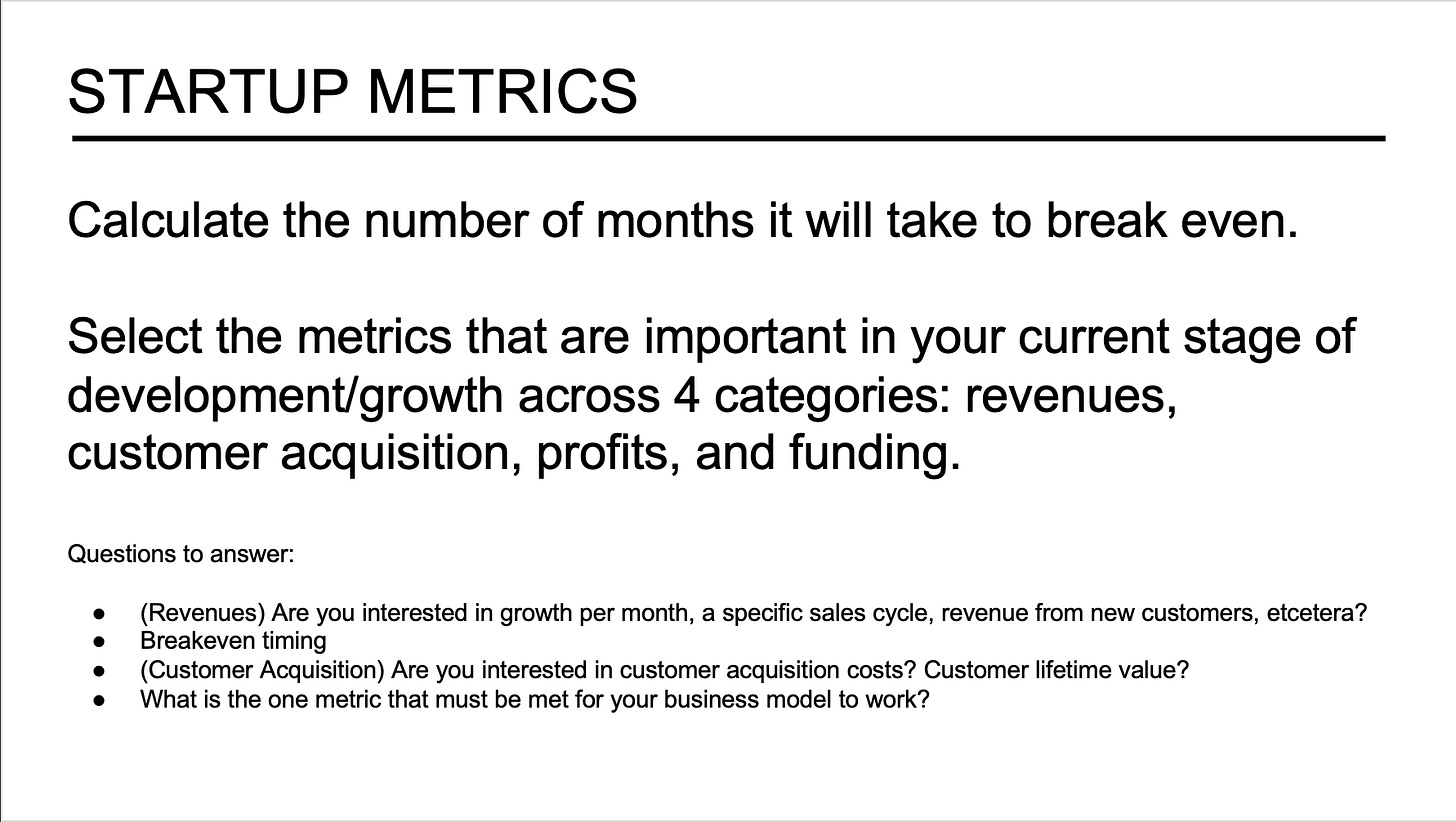

The reading deck highlights three financial areas: critical financial highlights, startup metrics, and fundraising strategies. Key financial highlights come directly from the results of your projected financial statements. You can highlight projected sales, sales cycles, unit pricing, and critical cost areas using graphs and charts.

Startup Metrics. Demonstrating to stakeholders that you are focused on specific results and are measurement-driven is a positive set of founder attributes. As I have written earlier, founders must monitor many potential metrics or key performance indices (KPIs). What to measure depends on the stage of your venture's development. While the fundamental metrics change as your venture evolves, there are four performance areas related significantly to your business model: customer engagement metrics, MVP metrics, profit model metrics, and resource acquisition metrics. Additionally, founders should identify one or two critical metrics that must meet certain levels for their business model to be viable. For the reading deck, consider the essential metrics for your stage of development and highlight that one metric that matters!

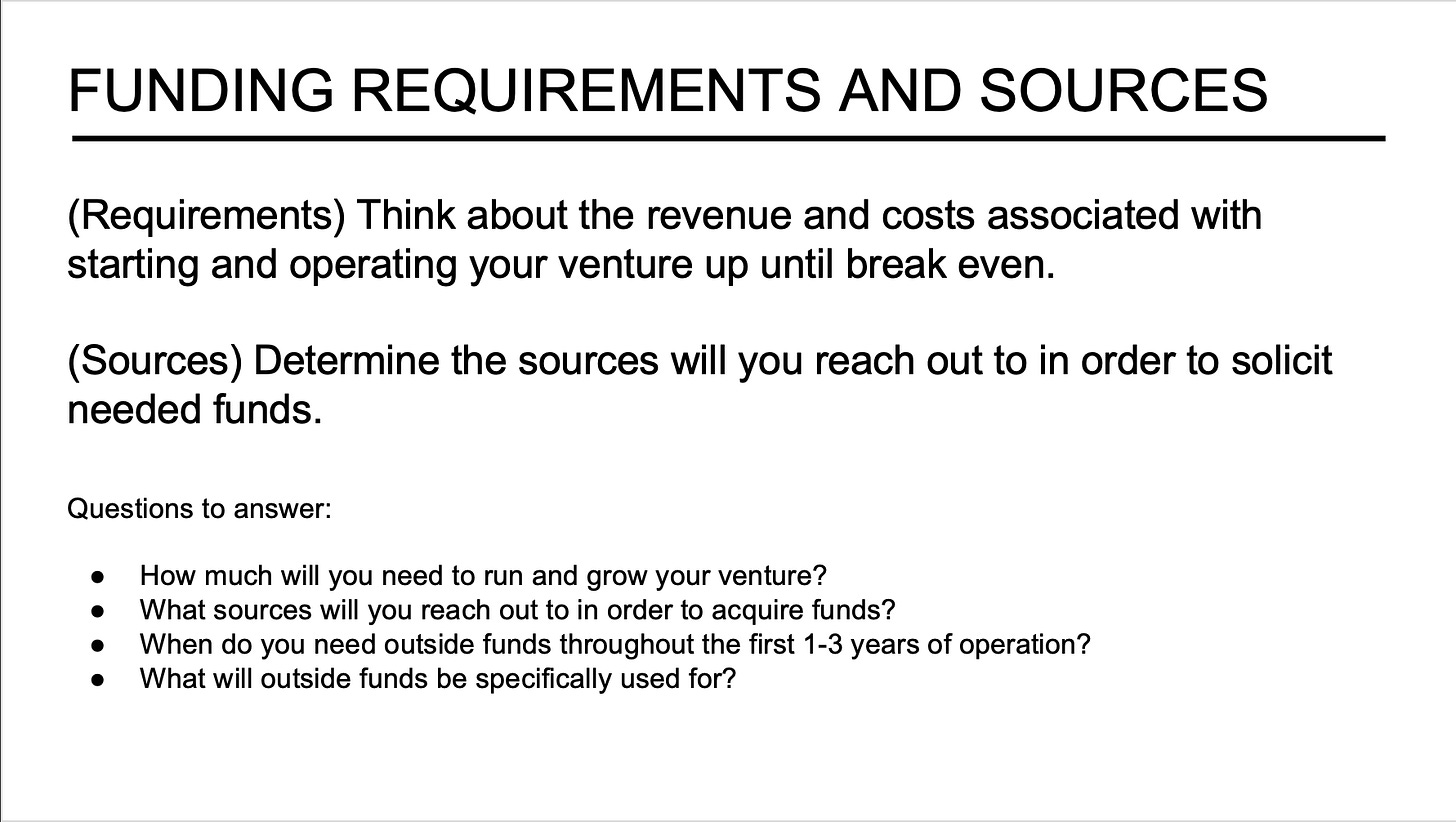

Fundraising Requirements. The funding section of the reading deck should describe how much money is required to finance the business, the uses of the funds, and when the capital will be needed. To determine financing requirements, entrepreneurs must evaluate and estimate the funds required for (but not limited to) research and development, purchases of equipment and assets, and working capital. For example, to finance the research and development of a product, entrepreneurs might experience a long delay between incurring research expenses and generating sales. Thus, it may be appropriate to fund these expenses with long-term financing. The content in this slide coincides with financial data noted in earlier slides and the financial statements in the appendix.

If you are fundraising, add information about the current round status, including how much has been raised, whether a lead investor is in place, and the company’s valuation in the current market.

A Guide to Building Reasonable Startup Financial Projections

Introduction Financial planning and analysis are critical skills for entrepreneurs to develop. To assess the viability of a business venture and communicate its economic prospects, founders must learn how to prepare critical financial statements. This article combines three essential topics related to startup financial statements: revenue forecasts, cost estimates, and pro forma statements.

6. Articulating Legal Status

Startups have several legal issues to address in the early stages of their development and before they launch into the marketplace. For the reading deck, there are a few things to highlight:

You can list any intellectual property you own. These assets include patents, trademarks, and copyrighted materials. Confirm that all intellectual property is legally assigned to the venture and that proper employee agreements are in place to continue said assignments.

You can state what form your corporate structure takes and in what state.

Highlight any other founder, employee, or investor agreements you have in place currently.

Selecting a Legal Structure for Your Startup

Introduction Entrepreneurs can quickly become overwhelmed by the many actions required to establish their new venture as a legal entity that meets all local and federal regulations. In many countries, the regulatory hurdles can be a barrier to entry in their own right. While there are several actions to take when starting a new company, I want to focus on your options for structuring the startup as a legal entity.

7. Highlighting Team, Advisors, and Partnerships

You should detail the startup team's talents and skills in this section of the reading deck. If the business plan is to attract investors, this section should emphasize the team's talents and indicate why this management will help the company have a distinctive competitive advantage. Entrepreneurs should keep in mind that individuals invest in people, not ideas. Detail the expertise, skills, and related work experience of the proposed founding team and the backgrounds of those expected to play critical roles in the venture. These include investors, members of the board of directors, key employees, advisers, and strategic partners.

8. Time to Launch | Critical Milestones

In this final slide, founders can offer information about essential goals and associated milestones relative to the current period. These milestones relate to major strategies and actions critical to the venture's stage of development. The focus may be product development testing iterations or steps towards market entry and early traction. If providing this information to investors, it may include funding rounds integrated with growth milestones.

Is Your Startup Ready for Launch? A Comprehensive Guide for Entrepreneurs

Innovate and Thrive Subscribers: How do you navigate life-changing decisions? As I wrote this article on evaluating startup launch readiness, it brought to mind an insightful Irrational Labs webinar I recently attended. It examined behavioral science research around navigating life-changing personal and professional decisions.

9. Appendices

Founders can include several items in the reading deck appendix. Standard items include financial statements, customer research data, product development (MVP) documents, and sample marketing and branding materials.

9.1 Financial Statements

Projected financial statements and projections are often prepared after basic market research and analysis. By preparing these statements, the entrepreneur knows which strategies will work from a financial perspective before investing many hours in writing a detailed description. Entrepreneurs should keep detailed notes on their assumptions so they can later include footnotes with their statements. For this course, we recommend you spend time detailing your first 36 months. Once you have an excellent financial model, most business plans include 36-month financial statements. The longer-term reports allow you to illustrate your assumptions about how your venture will grow and become profitable.

The financial plan is the least flexible part of a business plan in terms of the format. While actual numbers will vary, each plan should contain similar statements—or schedules—and present each statement conventionally. These statistics should have enough information to understand the business and how it relates to similar companies. In general, founders should provide the following information:

Assumptions: The assumptions based on projections should be clear and concise. Numbers without these assumptions will have little meaning. Only after carefully considering such assumptions can investors assess the validity of financial projections.

Projected Income Statements: These statements most often reflect monthly performance for the first three years.

Projected Cash Flow Statements: Develop statements as detailed as possible for the first three years.

Current Balance Sheet: This should reflect the company's financial position at its inception. Projected year-end balance sheets should also be included, typically for three years.

Other Financial Projections: This may include a break-even analysis demonstrating the level of sales required to break even at a given time.

9.2 Customer Data & Feedback

One subject that can be very beneficial is to include the customer data and analysis from your customer discovery and MVP testing activities. For example, for the customer discovery interview section, provide detailed information on customer interviews, including demographic data about the interviewees, details of customer discovery interviews (including all protocols, scripts, and survey questions) focusing on validation and invalidation findings on core assumptions, and a summary of what you learned and changed based on these early customer interviews.

For the MVP section, you should provide details of your MVP test design and information on who participated, including participants' demographic data and results from the MVP test. In addition, you should include plans for MVP 2 and what you plan to test next based on what you have learned in the first iteration.

Note on Business Model Canvas

Applying a business model canvas is a standard business plan development in the startup environment. In earlier posts, I discuss the relevance and application of the startup's formulation of business strategies. Many stakeholders in today's market will be familiar with the framework. So, if you use it as part of your planning process, I think it is worth including it in the appendix. This placement allows you to refer to it in your plan as appropriate.

Reading Deck Style Guide

Your reading deck should include pie charts, graphs, tables, and other graphics that effectively show how your business model works and how you will successfully provide value to the customer. The slides themselves should be appropriately branded and copyrighted.

Additional Reading Deck Applications

The reading deck is a foundation for other essential stakeholder documents, such as executive summaries, pitch decks, and explainer videos. Once the reading deck is in place, it provides content that can be readily re-purposed for other essential documents. Here is a brief review of other important stakeholder documents:

Executive Summary. Once you have completed your reading deck plan, including financial statements, you can summarize essential highlights of your venture. I recommend a 1-2 page document that outlines the critical points of your business model, including the problem to be solved, target customer and market size, competitive positioning, product development status, customer acquisition strategy, financial highlights, including capital required, and a brief profile of founders and key team members. This summary is typically a document that you send to interested stakeholders first. Then, if you are interested, you can schedule a meeting and make a presentation with your pitch deck. If appropriate, bring a copy of your reading deck and financial statements with meeting participants.

These summary documents can be narrative-based or in the form of an infographic. In general, this summary document must be impeccable, short, and concise and clearly describe the opportunity and the benefits of the targeted investor or partner. In addition, as with all documents, they should contain proper brand elements and copyrights.

Venture Pitch Slide Deck. By working on the reading deck, founders learn about their customers, market, and industry. Unfortunately, most interested stakeholders have limited time to hear your idea, so you must prepare venture pitches to get to the point quickly and understandably without much explanation.

While audience interests and needs will vary, here are some key issues to address in any presentation about your new venture. Pitches should provide the following information:

What are the product and service, and what problem is it solving? What are the benefits of the product?

What is your market/target segment, and who is the customer?

Why is your venture uniquely situated to exploit the opportunity you have cited- consider it in terms of entrepreneurial capabilities, core competencies, competitive advantage, and competitive strategy.

What is the current stage of development, and why are you seeking employees/funding/allies now?

Financial Upshot- How many people will buy it in the first and second years? How much will it cost to design and build the product? What is the sales price? How much investment are you seeking?

What is your timeline for launch, growth, or exit?

Most information required for the short pitch is in the reading deck. Therefore, founders can insert select reading deck slides directly into the pitch deck. Several pitch deck entries consolidate specific highlights from the reading deck into one slide. For example, a common practice is creating one slide communicating the customer profile or persona and crucial market size data.

Explainer Videos. Increasingly, entrepreneurs use video technology to promote their ideas and engage with potential investors and stakeholders. With the emergence of crowdfunding as one option for raising startup funds, video advertising is becoming an essential tool. Additionally, many venture competitors and accelerator programs require short videos as part of the application process. And now, with the latest low-cost technology, the cost and skills needed to produce videos are available to almost everyone. Your reading deck highlights many of the messages you want to convey in an explainer video. The added work, which is not trivial, is developing a storyboard or script to tell a compelling story via video. But with the script in hand, your reading deck already has the main messages about the customer problem, your solution and benefits, and how your venture's business model will provide value to the customer.

The Value of the Reading Deck

There are several advantages to creating a business reading deck. First, this document helps the entrepreneur to test the feasibility of the venture's business model but serves as a communication vehicle for all stakeholders. The primary purpose of the reading deck is to test the business idea's viability and set a path for the entrepreneur to follow.

The reading deck helps founders to determine if the idea of starting a business is feasible. The plan applies rigor and discipline, and the entrepreneur must provide in-depth detail about all aspects of business and how to execute the plan. It should reference solid research to support the opportunity and articulate founders' assumptions with supporting validating data from customers and various stakeholders. Working through the reading deck is an iterative process that helps concertize the critical assumptions. Working on and writing down a plan in detail helps an entrepreneur to be confident and able to answer probing and detailed questions.

The reading deck serves as a platform for other essential documents. For example, it is valuable in creating elevator pitches, executive summaries, and presentations. In addition, these build-on documents are vital to communicating with interested stakeholder groups you interact with throughout the venture realization process.

Finally, the reading deck allows bank loans and investors to understand the business idea and determine the financial requirements. A presentation may stimulate their interest, but a well-constructed reading deck they can take away and study may support any investment commitment.

Conclusion

The reading deck is the foundation for communicating your startup's business model, market opportunity, product benefits, and financial projections to potential stakeholders. It tells your startup's story in a comprehensive yet concise slide deck format.

While developing a reading deck takes time and effort, the rigor of detailing every aspect of your business is invaluable. It allows you to validate your assumptions, analyze the viability of your business model, and prepare for stakeholders' tough questions.

Once complete, the reading deck provides a platform to create other essential startup documents like the executive summary, pitch deck, and explainer video. Repurposing important content from your reading deck saves significant time developing these additional materials.

Utilize a framework like the venture realization roadmap modules to structure your reading deck. Organize the slides to logically take stakeholders through your startup journey, from identifying the opportunity to launching into the market.

Include relevant graphics, charts, and visual assets throughout the deck. Break up lengthy sections with headers and summaries. Provide enough detail to convince stakeholders, but stay focused on highlighting the most critical information.

Continually update your reading deck as your startup evolves. It becomes an invaluable archive documenting your venture's progress and lessons learned. Use it to keep stakeholders aligned with your vision amidst the exciting changes of a growing startup.

Keep reading with a 7-day free trial

Subscribe to Innovate & Thrive to keep reading this post and get 7 days of free access to the full post archives.