Introduction

Innovation has become a driving force in today's rapidly evolving business landscape. To stay competitive, companies need to constantly develop new products, services, and processes that meet their customers' ever-changing needs and preferences. However, embarking on innovation without a solid foundation is like building a house on shifting sands. That's where customer discovery comes in.

Customer discovery is a systematic process of identifying, understanding, and validating customer needs, pain points, and desires. It is a critical component of successful innovation strategies. By truly understanding your customers and their problems, you can create products and services that have a genuine impact and resonate with your target market. In this blog post, we will explore the importance of customer discovery and how it serves as the bedrock for successful innovation strategies.

Customer Discovery Fundamentals: Exploring and Validating Customer Needs

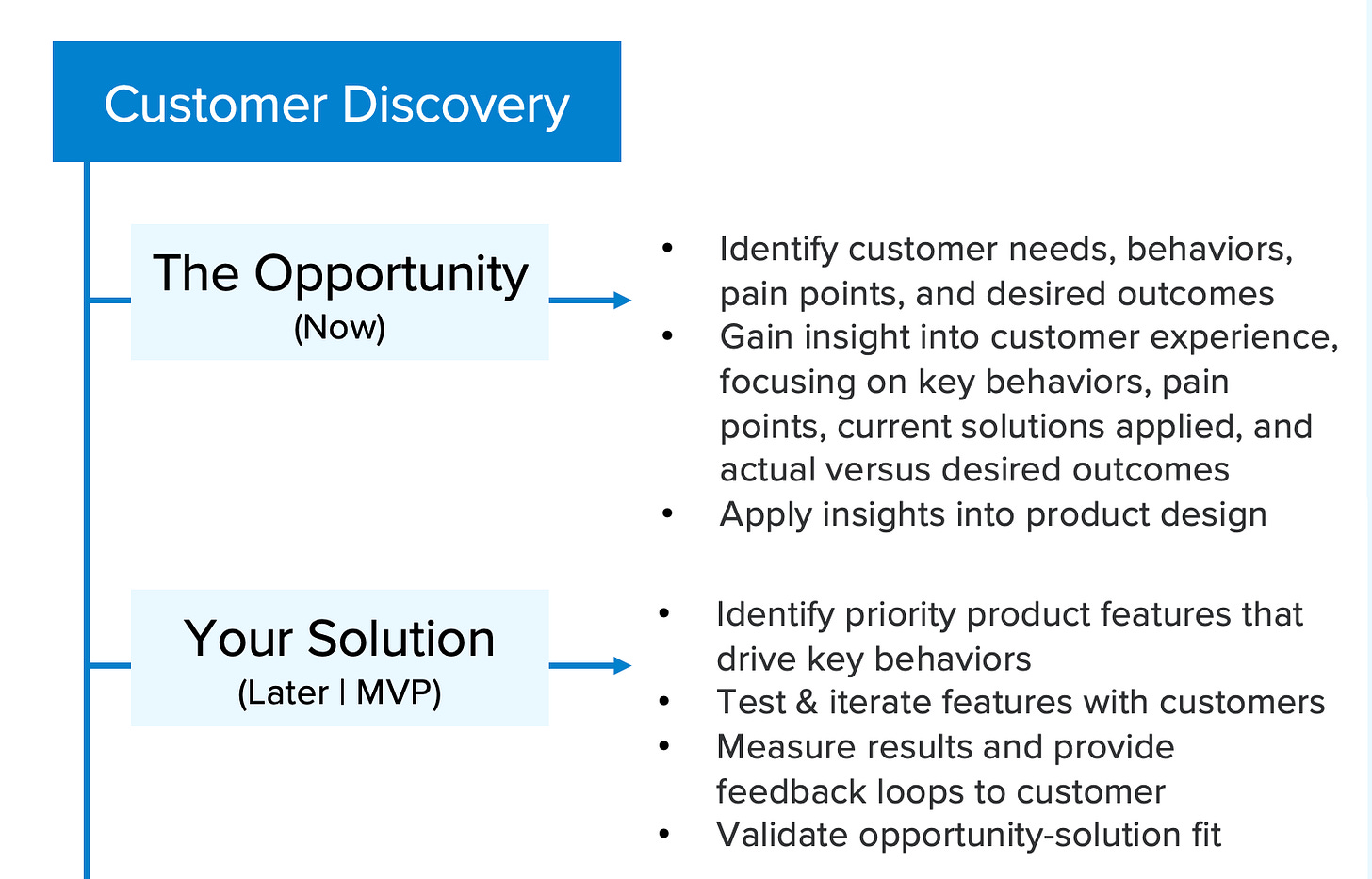

Customer discovery is a critical process in the journey of venture realization, consisting of two distinct stages: Opportunity Discovery and Solution Experience. In the initial stage, the primary objective is to validate assumptions about whether the venture idea aligns with specific customer needs, desires, and willingness to purchase. This phase revolves around establishing an "opportunity-solution fit" by examining the accuracy of your beliefs regarding the customers' current experience with a specific problem or need and their desired outcomes.

The early engagement phase focuses on acquiring extensive knowledge about customers' experiences with the opportunities you aim to address with your product or service. Key goals during this phase include understanding the frequency and severity of the customer's encounters with the problem, commonly known as customer pain points. Additionally, you delve into how customers currently address the problem, gathering information about existing solutions, potential competitors, and the price points associated with these alternative offerings. By exploring current solutions, you gain insights into what customers value the most about them and identify any gaps or shortcomings.

Once you have probed customers regarding their experiences with the opportunity and existing solutions, you can transition the conversation towards your proposed product idea — your solution. During this phase of customer discovery, you articulate your solution and seek feedback from those interested in addressing the problem. The objective is to determine whether your product idea has the potential to alleviate or mitigate the customer's experience with the problem. Furthermore, you aim to ascertain whether your solution outperforms existing alternatives and whether the anticipated benefits of your proposed product offering align with customer expectations. Asking the right questions becomes instrumental in gathering valuable insights.

As you proceed into the second phase of customer discovery, the focus shifts from understanding the customer's problem to evaluating your proposed solution. The objective is to determine whether your product idea creates substantial value for the customer — value significant enough for them to desire and be willing to pay for it. In future discussions, we will delve into this second phase of customer discovery in greater detail when exploring the design and development of a minimal viable product.

By diligently following the customer discovery process and iteratively refining your understanding of customer needs and preferences, you enhance your chances of developing a successful product that effectively addresses the market demand.

Customer Engagement: Interviews and Surveys

Customer interviews and surveys are powerful tools within the customer discovery process. Through interviews, you can engage in meaningful conversations, gather qualitative insights, and uncover deeper customer needs and desires. On the other hand, surveys enable you to collect quantitative data and broader perspectives from a larger sample size. By combining both methods and their findings, you can gain a comprehensive understanding of your customers and drive more effective innovation strategies.

Customer discovery is an iterative process; ongoing engagement with your customers is vital to staying ahead of their evolving needs. By incorporating customer interviews and surveys into your innovation toolbox, you can build stronger customer relationships, develop customer-centric solutions, and position your organization for long-term success in today's competitive marketplace.

Preparing for Early Customer Interviews

Customer interviews are a powerful tool in the customer discovery process. They provide an opportunity to have in-depth conversations with your target customers, allowing you to delve deeper into their needs, pain points, and preferences. You can ask open-ended questions, listen actively, and gather qualitative insights beyond surface-level understanding during interviews. By conducting customer interviews, you can uncover valuable insights that may not emerge through other research methods.

When conducting interviews, selecting a diverse range of customers representing different segments, demographics, and usage patterns is essential. This segmentation ensures a comprehensive understanding of your target market. Additionally, it's crucial to create a comfortable and non-judgmental environment, encouraging customers to share their honest opinions and experiences. Analyzing and synthesizing the interview information will help you identify patterns, common themes, and critical insights that shape your innovation strategy.

Once you have defined your target customer and market, you can prepare to engage them directly. This early customer engagement is a critical step in the venture realization process. The primary objective of these early interviews is to find evidence that your assumptions about your target customer are correct.

The primary objective is to validate your preliminary assumptions about the target customer profile and the problem they hope to solve. You should structure the interview to explore essential elements of the customer's profile and experience related to the opportunity, solution, desired benefits and outcomes, and purchasing process.

Unlocking Customer Outcomes: The Key to Startup Success

Introduction One of the most challenging aspects of navigating startup development is identifying and validating customer-desired outcomes. Understanding the customer's needs can be difficult to determine as customers cannot consistently articulate their desired results. Founders make several assumptions about these outcomes that need to be evaluated, prioritized, and validated through customer engagement, market research, and early product testing. Finally, startups must balance their customers' desired outcomes with their business objectives and constraints.

While you can conduct the customer interview semi-informally, preparation should be structured and well-organized. I recommend that you start by listing your core assumptions about the target customer and their experience with the problem to be solved or the job to be done. Are there critical demographic characteristics that you need to validate during the interview? What do you see as the problem? How important is it that your customer finds a solution? Are there other solutions, and are those solutions missing something the customer wants or needs? How much is the customer willing to pay for the solutions?

Once you have identified your core assumptions about the customer, identify any measures or metrics to quantify the customer's experience.? For example, can the customer estimate the problem's pain point? If the customer spends X amount of time on a task that they feel is onerous, how much time do they spend? This response will quantify the problem. Upon further exploration, you can then explore how much time current solutions save the customer. Are customers satisfied with the time savings? If not, what degree of time savings would be considered valuable? The answer will measure the customer's perceived severity of the problem and what gain they would expect from a new solution.

As part of these interviews, validating your assumptions about the target customer profile is essential. You must record the selected demographic information and behavioral characteristics of each interviewee. Do they fit your initial assumptions about the customer? It does not matter whether you focus on a specific customer segment; diversity can be helpful at this point. You will see how people with different demographics and characteristics perceive the problem, solution, and expected value.

The Interview Questions

Now you are ready to generate the questions you plan to ask during the customer interview. I suggest you create a short series of questions guiding the customer to describe their experience as a story. For example: Tell me about the last time you experienced said problem or job-to-be-done. As the customer describes their experience, probe for details about the problem, its timeframe, the severity of pain points, specific actions, and the customer's emotional state throughout the experience.

Core Customer Questions

Tell me a story about the last time _____________.

What worked well about _____________?

What was the most challenging thing about _____________?

Why was it the most challenging?

How do you currently solve it?

What's wrong with the current solution?

What would a solution have to do to help you achieve your goals?

Your questions should be mostly open-ended, allowing the customer to openly and freely drive the conversation without being led by your preconceived notions. I have listed some starting core questions to get you started. Once you have created your interview script, it is time to identify people who meet your customer profile.

After structuring your interview questions, you should conduct 2–3 test interviews as a practice run. You can see how the customer responds to the questions during these test sessions. You are soliciting the kind of information required to validate your assumptions about the problem, current solutions applied, and the desired benefits of a practical solution hoped for by the customer. For these test interviews, you can practice with people you know as long as they generally meet your target customer profile.

Focusing on Customer Actual Behavior

The main focus of the core questions is to develop a deep understanding of the customer's current needs and behaviors. One of the first principles to remember is that you must listen carefully to how your customer is behaving now. From the start, you should be probing how customers behave as they work towards their goals. You want to identify behaviors at what many call an "uncomfortably" specific level.

The Behavioral Thread: Navigating the Path from Discovery to Design

Introduction Understanding customer behavior is crucial when starting a new venture or developing a new product. It serves as the fundamental element that holds your business model together. Neglecting the time and effort required to comprehend your customers' objectives and the behaviors necessary to achieve those goals can jeopardize the success of your venture.

There are several methods to facilitate this probing activity. For example, the Five Why method can help customers articulate more contextual and behavioral details. This approach helps to understand the customer's experience with the problem by repeatedly asking "why" the interview progresses from the surface-level issue to the underlying cause. This interview method allows the interviewer to gain a deeper understanding of the problem and gather insights for further investigation and improvement.

The contextual inquiry method observes the customer's interaction with a product in their natural environment. In the customer discovery stage, the focus may be on a competitor's product that the customer currently uses. By having the customer walk you through how they use the product step by step, you learn about specific behaviors along with their motivations, preferences, and pain points. This method helps founders gain specific insights into the product's functionality and potential areas for improvement from the customer's perspective. This method helps the founder understand the customer's experience in a real-world context and make informed design decisions to enable future products to address customer needs in a better and differentiated way.

Another method similar to a contextual inquiry approach is ethnographic interviews. This method adopts an anthropological approach to understanding customers' cultural and social context. This method involves spending time with customers, observing their routines, and conducting interviews to uncover deep insights into their behavior and motivations. While this can be time-consuming, it can provide an in-depth understanding of the customer's current behavior in dealing with a specific issue. For example, I had a student designing a product that would help customers manage their wardrobes so they would know what they currently have and what new fashion items to purchase for specific occasions. Early in the customer discovery process, the founder would spend time in the customers' homes and observe how they organized their closets, selected outfits for specific occasions, and decided when a new item was warranted. The founder documented these observations via video for review and analysis.

Having customers keep diaries and journals of their experiences can be another approach to discovering specific behaviors and mindsets when trying to accomplish a goal. This method provides longitudinal insights into their behavior, habits, and challenges, allowing for a more comprehensive understanding. I have had some students use this approach along with text messaging prompts. Founders can design a schedule of prompts to be sent via SMS to customers throughout the diary study period. These prompts can be reminders to document specific activities, capture thoughts or experiences, or answer predefined questions about their behavior. One of my former student founders applied this approach to capture customer thoughts and behaviors associated with negative thinking and emotional responses. The learning from this approach helped her build a cognitive behavioral program and application to help diminish the number of negative thoughts a person has daily and increase mental well-being.

Pain Point Interviews focus on the obstacles that get in the way of the customer behaving in a certain way or achieving their goals. These interviews aim to identify specific pain points, the degree of severity, the context in which they occur, and customer attempts to mitigate them. These interviews lean into the customer's challenges and usually start by asking about their biggest challenge when doing a particular task. The interview protocol focuses on a specific task and context. It can be a helpful approach in later phases of customer discovery after you have validated the importance of the opportunity.

These interviews typically start by asking customers to describe specific situations or scenarios where they faced challenges, frustrations, or encountered problems related to the area they are exploring. Encourage them to provide details about what happened, why it was problematic, and the consequences or impact it had on their work or life. You may apply the five why technique to support in-depth probing for root causes of the pain points. During these interviews, you should take thorough notes, capturing each participant's pain points, frustrations, and obstacles. It helps to record direct quotes and specific examples to capture the essence of the customer experience. Once you have conducted several of these interviews, review and analyze the interview data to identify common themes, patterns, and recurring pain points. Group the pain points based on similarity or severity to prioritize the most significant issues. I have had students use Miro Boards to support the identification of trends and patterns across interviews.

Journey Mapping and Storyboarding is a practical approach to discovering customer behavior by creating visual narratives that depict the customer's journey, experiences, and interactions with a specific problem or task. It helps identify pain points, emotions, motivations, and opportunities for improvement. In the context of early customer discovery, these methods focus on the customer's thoughts and actions before accessing your solution (pre-purchase, typically pre-awareness). In these narratives, one envisions how customers are engaging with other brands to find a solution to their problems. This information is invaluable to understanding how the customer looks for answers, their decision process, and what options currently exist in the marketplace. The focus is on the customer's experience with the problem, emphasizing all the challenges throughout the process. A startup's early product ideas have not yet entered the picture.

Journey into the Customer's Mind: Using Experience Maps for Behavioral Insight

Introduction In the past, I highlighted the role that design thinking plays in problem identification and solution design. Within the design thinking approach, several tools and practices are helpful to entrepreneurs as they seek an optimal solution for customers. These tools support the development, articulation, and documentation of your early assumptions about the customer's experience with the problem they are grappling with or a goal to accomplish. In addition, several design thinking tools incorporate graphical visualization to support your conceptualization of the customer experience.

How Many Interviews?

Most startups ask how many interviews are enough. Quite frankly, no one answer covers all circumstances. If you are conducting these interviews with potential customers and don't have a current product, you may want to consider at least twenty-five consumer-based interviews. I break these 25 interviews into three phases: Pilot Interviews, the First Ten, and the Final 20-25. You will be looking for specific information and trends in each phase.

As noted above, the objectives of the first 2-3 interviews are to pilot and refine your interview protocol. At this juncture, you can re-assess the questions and sequencing and see if the customer is discussing their experience in context and articulating how they currently behave in the situation.

Once you feel that you are deriving the correct information from these early engagements, I suggest you go for the subsequent ten customer interviews. With ten interviews, you can begin to see patterns in these discussions. By this point, you are looking for potential validation of your core assumptions about the customer profile, experience context, goals, key behaviors, and desired outcomes. After ten interviews, founders should have a good sense of whether they are addressing a severe customer issue, that significant obstacles are getting in the way of desired goals, and whether there is significant dissatisfaction with current marketplace solutions. You are looking to understand how much effort customers exert to find products that support accomplishing their goals. Your target customers must actively engage in these activities, measured by effort, time, resources, and money spent.

After these ten interviews, you should start to feel confident that you are speaking with the right customers and that a few customers are genuinely excited that you are looking into this opportunity. If there is no or limited excitement after ten interviews, you are speaking to the wrong target customer or have yet to identify a severe need area. In either case, it is time to reconsider your current assumptions.

However, if you see positive responses and some trends emerging after ten interviews, you can go after the next series of interviews to conduct 20-25 sessions in total. Now that you have some patterns emerging, you can probe deeper into this discussion, challenging patterns to support validation. Like the scientific method, you want to focus on disproving your assumptions. It is important to note that you should not be bringing these patterns up in the interview. You should be waiting for customers to bring up the issues independently. If they don't bring it up, you can consider addressing it by presenting the opposite perspective to see how they respond. You need to be careful not to bias the customer by leading them to address patterns that did not come up naturally.

By the time innovators conduct 20-25 interviews, there should be a clear pattern of responses as to the essential questions of customer profile, context, need, key behaviors, obstacles, and desired outcomes. Hopefully, if one reevaluates each interviewee cohort, you will have enough validation to consider shifting to product design and testing.

Finding Initial Interviewees

Once you have refined the interview questions based on these practice sessions, identify the first ten customers you plan to speak with regarding the problem. These interviewees should be individuals that meet your general customer profile as you currently understand it but who are not previously known to you. You are now looking for actual early customers who are actively looking to solve the problem and have an urgent reason to speak to someone about their experience unbiasedly. This selection criterion is the only way to maximize your learning about the customer's needs and solution requirements.

As a starting point, list ten potential customers and their contact information. Once you have your questions organized, schedule a time to speak with each customer. Of course, you will need to talk to many more customers during the discovery process, but these first ten people can give you a sense of whether you are on to something. It also helps to evaluate whether you ask the right questions to the right customers.

It is essential to acknowledge that business-to-business customers (B2B) can often be challenging to pin down and schedule time on their calendars. You might be lucky to find even a small number of business owners or executives willing to meet with you in some cases. Your experience with engaging B2B customers can be an authentic learning experience for you. The responsiveness or lack thereof are data points and early feedback for you to assess. It would be best if you did not jump to immediate conclusions. You will seek evidence of the business's interest in solving the problem. Is there a strong interest and immediate need to solve the problem, or is it low on a priority list? Are you targeting the right business segment, or are you reaching the right decision-maker? Again, don't jump to conclusions; take early responses as data to interpret as you solicit more and more information.

Essential Steps for B2B Customer Discovery: Building Sustainable Business Relations

Introduction Establishing and nurturing strong business relationships is crucial for the long-term success of any B2B company. Customer discovery is vital in this process, helping you understand your target market, identify key decision-makers, and develop meaningful connections. In this blog post, I outline the essential steps for B2B customer discovery…

After you have had the opportunity to interview the first ten target customers, you can take stock of what you are learning about the customer's needs and behaviors. Summarize what you have discovered, assess where you stand by validating your core assumptions, and decide how to proceed with your business model's continued development. Conduct a debrief after every ten interviews until you see common customer response patterns. As mentioned above, by 25 interviews, you should have a good sense of whether you have the right target customer and need area to support future product design activities.

There are many other elements of the interview process to consider. These considerations include finding your target customers to interview, articulating the purpose of the interview, and the most effective ways to conclude the interview.

Finding your target customers can be challenging. For this reason, I ask aspiring entrepreneurs to assess early in the process the degree of access they have to potential customers. Even in the best of circumstances, finding willing interviewees is difficult. There are many ways to reach your target customer, starting with your network of friends, family, and professional acquaintances. Linkedin and other social media platforms can be applicable at the start. You want to capitalize on your network to help introduce you to people you don't know— - their friends, families, and connections. Depending on the problem you are trying to solve, there are always specific online communities or associations to recruit target customers. Students successfully place targeted ads on social media platforms to solicit interested parties.

You learn a lot from understanding where you can best reach your interviewees. Keeping track of where your potential customers heard about the interview provides early insight into the more effective ways to access them in the future. This information will help you create an early market entry strategy and inform you of the most effective promotional channels.

Introductions and Closings

The following vital element to consider is the optimal way to introduce the purpose of the interview. You will want to consider how to introduce yourself and the reasons for wanting an interview without biasing how the target customer will respond to the questions. I always worry that if customers know you are an entrepreneur, they will want to know what your product is, how it works, and so on. For this reason, I suggest you introduce yourself as someone researching a specific problem and looking to understand it better from people with the proper experience. This introduction allows you to stay focused on the problem and not lead to questions about your specific solution.

There are a few essential questions that you can ask as you conclude your interview session. Start with a recap that communicates to your potential customer that you have listened carefully. It also allows you to check if there is anything else on the customer's mind. Try this: - "In summary, it sounds like this part of the job/task is quite challenging to deal with, while some other aspects cause less concern. Is there anything else I should have asked about this task/job/challenge?"

The second ending question ascertains if they are interested in following your progress and learning more about your work. Something like: - "Thank you for sharing your experience with me. Would you be interested in staying in touch? I want to share the findings from the research and any next steps planned in the future with you." Of course, this questioning line helps to validate exactly how interested they are in the problem and your work on it.

A final question can focus on expanding your respondent pool by checking if they are willing to refer you to someone they know who is experiencing the problem. You may ask: Try - "Do you know anyone also interested in solving this problem? Would you mind providing an introduction?"

Customer Discovery Surveys

Customer surveys are another valuable tool for gathering quantitative data and feedback during customer discovery. Surveys allow you to reach a larger sample size and efficiently collect data on a wide range of topics. By designing well-crafted surveys, you can obtain specific information about customer preferences, satisfaction levels, and behaviors.

It's essential to define clear objectives and craft concise, relevant, and unbiased questions. You can administer surveys through various channels, including email, online platforms, or on-site. Offering incentives such as discounts or exclusive content can encourage participation and increase response rates. Once the survey data is collected, it can be analyzed to identify trends, correlations, and insights that inform your innovation strategy.

While interviewing customers is a preferred method for early customer discovery, there are many reasons to consider using a survey or questionnaire to solicit customer information about the problem, current solutions, and desired benefits. One of the significant benefits of online surveys is the ability to reach large numbers of customers in a relatively short time frame. However, designing surveys properly to solicit valid information from customers is challenging. The survey must ask questions that are context-specific and unambiguous. To create a survey that meets these criteria, you need to have interviewed several customers to learn the context and the language they use to discuss their experience or use a third party with substantial experience with the specific customer base.

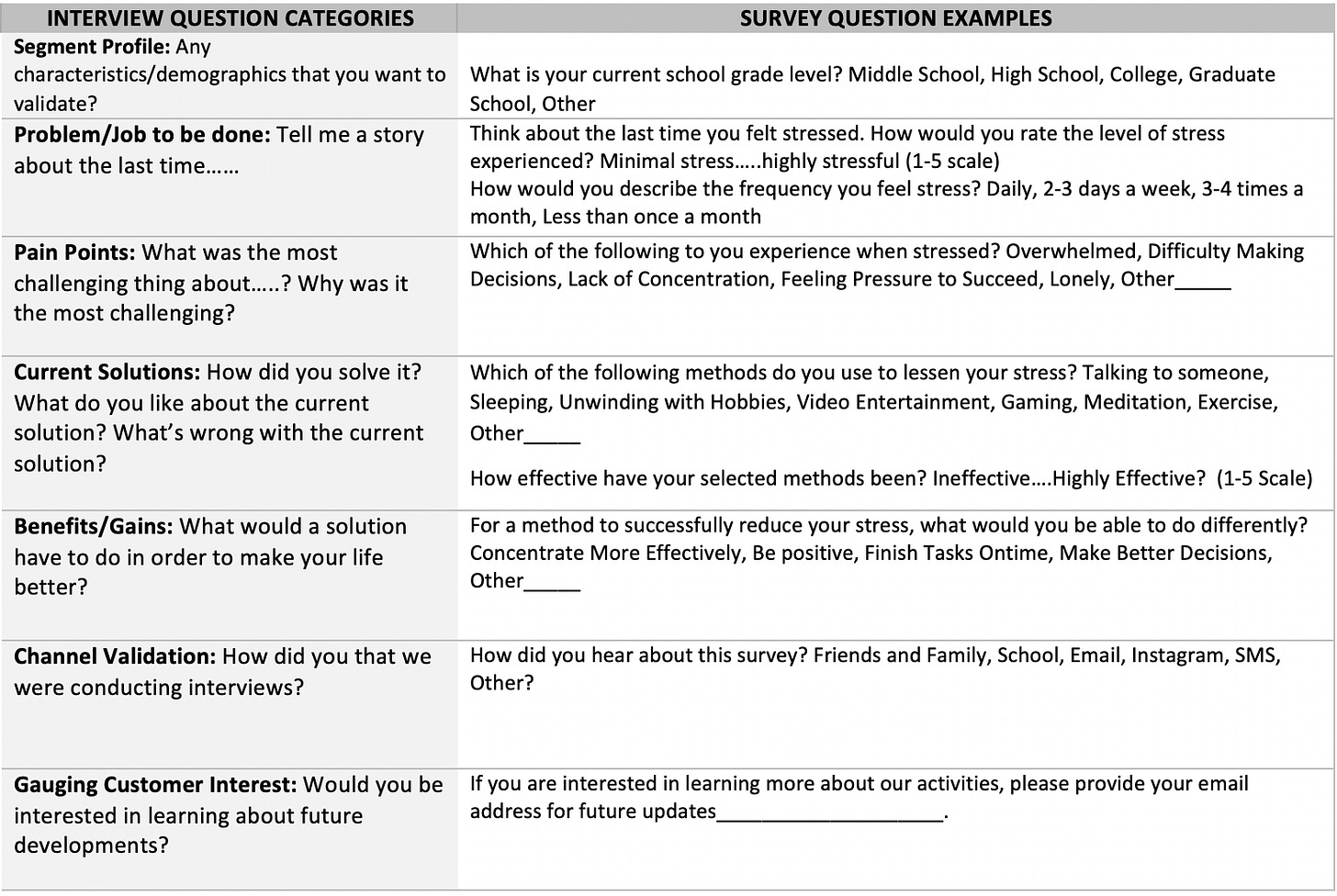

I suggest you follow the question protocol like the more semi-structured, open-ended customer discovery interview. Start with a general introduction that explains who you are (student, researcher), what problem you are investigating (purpose), and how long the survey should take (5-10 minutes recommended). I usually thank them for completing the survey upfront and in advance.

After the survey introduction, you should design your questions to solicit information about the customer's experience with the problem, specific challenges, application of current solutions, and desired outcomes. As noted, you can follow a similar script as you use in an interview, except the questions solicit quantifiable responses. See the table below for an example.

Survey Questions

The first set of survey questions should help validate that the respondent is part of your target market. Questions may include specific demographic data such as age, gender, level of education, location, etc. You only need to focus on particular customer profile elements that are essential to how you have segmented your customer base. One noteworthy mention is that sometimes you may need to ask sensitive questions. Questions about income or specific health conditions fall in this category. In this situation, you may want to place these questions toward the end of the survey. Additionally, provide a "prefer not to say" response.

After collecting the required demographic data, move to the questions designed to validate your assumptions about the customer problem, the challenges they experience, which solutions they have tried recently, and what behavioral or emotional outcome they would like to achieve from an efficacious solution. Designing these questions can be pretty challenging. You are taking your initial assumptions and creating a way for the customer to respond in a quantifiable form. For example, in a customer discovery interview, you have the customer tell you about the last time they experienced a specific situation or job to be done. You ask this very open-ended so you would solicit a direct, unbiased response from your customer. When you structure a survey question, you now list specific actions, behaviors, and emotions occurring during the problem to be solved or the job- to be done. In effect, you anticipate specific optional responses and hope to learn about those selected the most within your customer sample. Selecting the appropriate response options is vital and is ascertained during customer interviews. After several interviews, you will better understand the actions, behaviors, or emotions the customer experiences. Importantly, you will have learned how the customer describes these experiences in their language. This way, the survey questions will be more understandable to the customer respondent, making the survey responses more reliable and valid.

After you have asked a few questions about the customers' experience with the problem and the specific challenges reported, you can focus on what solutions they have used to solve the problem. Learning what solutions they have tried is an invaluable source of information. You will identify alternative solutions in the market, whether direct competitive solutions (similar to your product idea) or indirect options that solve the problem differently. Again, through interviews and market research, you should have a sense of the solutions out in the market and list them to see which ones the customer uses the most. Of course, as in many of these questions, you can add the "Other" option to learn about other solutions that are not on your radar. Through questions about optional solutions, you can learn who your competitors are, where these solutions are under performing, and, often, how much the customer is paying for these solutions. Thus, you now understand how proactively they have pursued solutions and how much they have historically paid for such outcomes.

The last series of questions can provide beneficial information for your venture. The first question is to ask the customer how they heard about the survey.? Here, you should provide all the channels you used to solicit customer respondents. Your listing should be particular and align with the methods you used. For example, if you use certain social media, list them individually— - Instagram, Facebook, WhatsApp, etc. Information about which channels resulted in strong response rates is critically important data. This information provides early historical data about your sales funnel. What are some of the best ways to create awareness and potentially quality leads for your venture? By responding, you know you reached them, and the customer was interested enough to take action and - complete your survey.

The other question that complements the channel question is asking whether the customer is interested in staying in touch with you. By checking "Yes" or leaving their email, they communicate their interest in solving the problem. Validating their interest in conjunction with how they learned of the survey now gives you some early conversion data by promotional channel. For most new ventures, this is the first time you discover this kind of information, which will play an essential role in customer acquisition strategies later in the venture realization process.

A final question that can help expand your list of potential respondents is to ask the customer to recommend someone dealing with the same problem. While this question may not always be appropriate in specific problem areas, it can help expand your respondents' pool. Even if you ask them to send the survey link to people in their network, this can significantly enhance your response rates. Sometimes, you can provide incentives for such referrals, such as educational content on the problem in the form of a free PDF.

Testing the Survey

As with customer discovery interviews, it helps conduct an initial trial run survey with several target customers— - friends or colleagues are good sources to check for question clarity and language use. You want to ensure the questions are transparent, answerable, and unbiased. Question clarity comes from statements that use precise language using vocabulary that your customers will understand. Avoid asking multiple questions - you won't know which question that respondent answered. The order of questions and answers can influence how the customer thinks about the topic and the subsequent response. There are several approaches to avoid biasing questions, including randomizing the response choices for particular queries. This issue arises when your assumptions are part of a list of response options. For example, if you anticipate that your target customers already use specific competitor products, you will want to embed these product choices randomly among other optional responses.

Getting your survey in the best shape possible is vital before expanding your sample size. Don't be afraid to send out several iterations to small numbers of target customers and reflect on the responses until you are sure the survey meets all the critical criteria, as noted above. Once you are ready, you will look for a large number of respondents.

Unlike interviews, surveys allow for reaching a much broader customer base, and sample size matters. The larger the sample of respondents, the more you can trust the information gathered. Again, there will be differences in the number of respondents you acquire in Business-to-Customer (B2C) versus Business-to-Business (B2B). While there are many ways to think about the target number, I suggest that your goal should be at least ten times more respondents than interviews. If you initially interviewed 50 consumers (B2C), consider 500 survey respondents a worthy goal.

Documenting Customer Survey Findings

Considering how you plan to analyze the data before designing the survey is good. Think about the analysis method and how to show the findings to others best. Deciding how to visualize optimally and display survey data will help you design the questions best to produce said informational outcomes.

In general, you look to demonstrate results and validate assumptions in three areas. Were you able to validate that the interviewees were part of the targeted customer segment – the beachhead? Here you can consider if any changes are necessary to your initial segmentation and other segments worth exploring. Additionally, you should evaluate how the various channels reach your segment. Keep the ones that bring many validated customer segment respondents and test new access channels as needed.

The second finding area to document is how your assumptions about the customers' experience with the problem and its severity align with what you learn from survey responses. What have you learned about the customers' experience with the problem you hope to solve, what challenges stand out, and how anxious they are to solve the problem?

Finally, you want to see if your target customers actively search for solutions and which ones they have experienced. You will learn how these solutions work and what they are missing, which you must determine before you start designing your solution. Most importantly, you will better understand the customer's needs in an effective solution and the most desired outcomes.

Combining Interviews and Surveys for Holistic Insights

While customer interviews provide qualitative insights and surveys offer quantitative data, combining both methods can provide a more holistic understanding of your customers. The qualitative data from interviews help you explore the "why" behind customers' behaviors and preferences, while surveys provide a broader perspective and statistical significance.

By triangulating data from interviews and surveys, you can validate findings, identify patterns, and gain a comprehensive view of your target market. This combination of qualitative and quantitative insights strengthens the credibility of your customer discovery process and allows you to make more informed decisions when shaping your innovation strategies.

Other Venture Benefits

Customer discovery is not just about gathering information; it's also about testing and validating assumptions. As innovators, we often have preconceived notions about what customers want or how they behave. However, these assumptions can be flawed or incomplete. Through customer discovery, you can challenge these assumptions, gather evidence, and refine your understanding of customer needs and behaviors.

Collecting Early Sales Funnel Data. One significant upside of collecting data throughout the customer discovery process is gaining early insight into sales. Documenting every aspect of the discovery process, from initial contact to engagement, provides early data on how much time you spend moving the customer from awareness to a specified call to action. At this point, calls to action may include referring you to other potential customers, interest in future updates, and willingness to participate in future product testing.

CRM Systems' Essential Role in Early Venture Development

Introduction For most startups, the customer relationship management (CRM) concept comes into focus at the launch stage. CRM is commonly associated with a specific software application that supports customer data collection and workflow during the sales process. However, CRM use should start much earlier in the venture realization process. In fact, as a founder, you should consider establishing a CRM strategy during the early pre-screening of the opportunity you wish to pursue.

Creating Customer-Centric Solutions. Once you have gathered insights and validated assumptions, developing customer-centric solutions is next. By involving your customers in the innovation process, you can co-create products and services that meet their needs. This collaborative approach increases the chances of success and creates a sense of ownership and loyalty among your customers.

Minimizing Risk and Maximizing Success. Customer discovery acts as a risk mitigation strategy for innovation. By investing time and effort upfront to understand your customers, you can avoid costly mistakes and minimize the risk of developing products or services that fail to gain traction in the market. By building your innovation strategy on a solid foundation of customer insights, you increase the likelihood of success and reduce the chances of wasted resources.

Evolving with Customer Feedback. Customer discovery is not a one-time activity; it's an ongoing process. Customer needs and preferences evolve, and your innovation strategy should evolve with them. By continuously seeking customer feedback and iterating on your products and services, you can stay ahead of the competition and understand your target market deeply.

How Artificial Intelligence Supports Customer Discovery

Artificial Intelligence (AI) supports startup founders' quest to learn more about their customers. By leveraging advanced algorithms and data analytics, AI empowers startups to gain valuable insights, make informed decisions, and create tailored experiences.

AI enables startups to analyze large volumes of customer data, identify patterns, and extract meaningful insights. By leveraging advanced algorithms, AI can uncover hidden correlations and trends within the data, providing founders with valuable information about customer behavior, preferences, and needs. I recommend that founders record all interviews and follow-up conversations. Once recorded, you can convert it into transcripts and run the content through generative AI programs to look for trends in customer data.

You can also take your customer discovery data from interviews and surveys to segment customers into distinct groups based on various criteria such as demographics, behavior, and preferences. This segmentation allows founders to understand customer segments better, tailor their marketing strategies, and develop targeted campaigns to engage and convert specific customer groups effectively. Startups can leverage these insights to anticipate customer needs and align their offerings and strategies accordingly.

Finally, founders can apply these data analytics to deliver personalized customer experiences. By analyzing customer data, AI algorithms can create personalized messaging throughout the early engagement period, enhancing the overall customer experience and leading to increased engagement and the likelihood of future conversions and advocacy.

Conclusion

Customer discovery is essential for successful startup strategies, focusing on understanding and validating customer needs. The process involves two stages: Opportunity Discovery and Solution Experience, exploring customer experiences, solutions, and competitors. Engaging customers through interviews and surveys provides valuable insights into their behaviors and preferences. Various methods like contextual inquiry and journey mapping aid in understanding customer motivations. Surveys are practical tools for gathering quantitative data on preferences and behaviors. Combining interviews and surveys provides a holistic understanding. Other benefits include early sales funnel data, customer-centric solutions, risk mitigation, and evolving with customer feedback. CRM systems and AI analytics further support customer discovery efforts.

Keep reading with a 7-day free trial

Subscribe to Innovate & Thrive to keep reading this post and get 7 days of free access to the full post archives.