Market Analysis for Startups: A Founder's Guide to Industry and Ecosystem Evaluation

Venturing forth with strategic vision.

Introduction

Market research and analysis are indispensable for startup success and growth. This article explores two robust frameworks entrepreneurs can leverage to gain strategic insights into their target market's dynamics and ecosystem: industry analysis and startup ecosystem analysis. We will examine key elements of conducting industry analysis, including identifying your industry classification, researching historical trends and growth patterns, monitoring technological changes, analyzing the competitive landscape, and identifying influencers. We will also look at components of assessing your surrounding startup ecosystem, such as advisor and mentor networks, funding sources, infrastructure support, and talent pools. With insights from both frameworks, founders can make informed decisions and craft data-driven strategies tailored to capitalize on high-potential opportunities in their marketplace. The knowledge gained will equip entrepreneurs to navigate uncertainties on their journey adeptly.

Industry Analysis: It is crucial to stay informed about industry trends, competitive solutions, and key players in the marketplace to build a successful new venture. Analyze the industry landscape, including market size, growth potential, and emerging trends. Identify your direct and indirect competitors and evaluate their strengths, weaknesses, and market positioning. By understanding the competitive landscape, you can differentiate your offering and identify unique value propositions for your customers.

Startup Ecosystem Analysis: This area focuses on the supporting regional infrastructure that can aid in realizing your venture. Explore the startup ecosystem within your target market, including access to funding, mentorship programs, networking opportunities, and regulatory environment. Assess the availability of resources and support systems that can contribute to the success of your venture. Understanding the startup ecosystem will help you leverage available opportunities and navigate potential challenges more effectively.

You should conduct these analyses throughout your venture's development and post-launch stages. In the early stages, perform a preliminary review of these areas as part of your pre-screening activities to assess the suitability of the venture idea for the founding team. Then, during the customer discovery and market research phases, conduct a more comprehensive analysis by combining primary customer discovery, such as interviews and surveys, with secondary market research. This approach will provide a holistic understanding of the relationship between customer needs and satisfaction with existing options, enabling you to effectively align your product innovation and venture strategy.

Industry Analysis

Conducting a robust industry analysis provides startups with invaluable insights into their target market's competitive forces, trends, disruptions, and opportunities. Critical analysis of your industry includes identifying where your venture fits within standard industry classification systems, researching historical performance and growth patterns, monitoring technological changes and innovations, evaluating the competitive landscape, and discovering influential experts and domain leaders. By thoroughly investigating these areas, startups can realistically assess their positioning, differentiate their offerings, recognize unmet customer needs, and make strategic decisions aligned with marketplace realities. An informed perspective of the industrial landscape equips entrepreneurs to carve out their niche while adapting their strategies as the industry evolves.

Step 1. Classifying Your Industry

Understanding how to classify your startup across various elements effectively has always been a crucial aspect of business planning. One of the fundamental principles of strategic planning is comprehending your internal capabilities and the external environment in which your business operates. The distinction lies in the matter of control, as the external environment is beyond an entrepreneur's influence. In a traditional SWOT analysis, you examine the opportunities and threats arising from the external environment. Internally, entrepreneurs need to evaluate the resources they bring to the venture.

This belief remains true today, but classifying startups, determining their industrial position, and defining their new venture status have become more complex in recent years, making it challenging to pinpoint where a particular venture fits. Consequently, multiple industrial classification systems, various sector and sub-sector categories, diverse business model types, and general startup classifications have emerged. Furthermore, experts disagree on which classification systems are still relevant in today's dynamic business environment. Some argue that many enterprises span multiple industries, and a single industrial classification cannot accurately define these complex sectors.

Nevertheless, I contend that conducting a thorough analysis of the external environment in which you plan to launch and compete remains relevant. However, it is essential to streamline the investigative process. Therefore, as a starting point, let us examine the crucial industry-specific information to capture during the venture realization process.

I encourage founders to identify the industry classification and sector where they plan to operate and compete. Founders should consider one of two classification systems: the North American Industry Classification System (NAICS) or the preceding Standard Industrial Classification (SIC) code system. By researching your classification within these systems, you can begin with a primary type that aligns with your venture.

Traditional Industry Classifications

The first step to better understand your industry is determining how to best classify your venture in "industry" terms. As mentioned earlier, this is not always as easy as it seems. Specific classification systems will afford you different types of information and data. So to an extent, you should plan to apply strategies that provide the best information for your needs.

For industry analysis, I have founders look at two classification systems, the North America Industrial Classification System (NAICS) and The Global Industry Classification Standard (GICS). The NAICS has been the standard since 1997. It is updated frequently with the current data updated in 2017. The NAICS replaced the SIC codes, the earlier business classification. That said, many research databases still use this system. So it is worth looking up both and using readily available conversion tools to take one of the codes and translate it to the other system. The GICS, developed around 1998, is designed to support the global business community. This classification system and the similar Industry Classification Benchmark (ICB) provide research data on public companies categorized into sub-sectors. There are minimal differences in how these sub-sectors are defined and categorized.

With some practice and patience, these data systems help founders identify the venture's industry, significant trends, and specific activity within the targeted geographic area, identify and evaluate competitors, and estimate market sales potential.

Industry Vertical Classifications

A second approach to industry classification focuses on startups that cut across multiple industries. Sometimes referred to as industry or market verticals, these categories reflect companies concentrating on a specialized market niche spanning numerous industries. For example, a startup labeled a fintech company provides technology solutions to facilitate financial services to various industries. There are a large and growing number of these industry vertical categories. For example, Pitchbook lists over 100 vertical classifications, including "emerging spaces" that embrace growing areas that may eventually become well-recognized verticals. Examples of these emerging verticals range from autonomous delivery to sleep tech.

I encourage founders to consider where they best fit into these vertical industries. Positioning your offerings and markets helps structure your market research and communicate your value proposition to customers, partners, and investors. Here is a list of startup sectors I have founders start with to consider where to position themselves for further analyses best. They can also go to the Pitchbook list or the categories used by the Startup Genome for other options that they feel are a better fit. Finally, I have them review this list with the more traditional classification approaches to optimize their industry research efforts. Founders typically find these categories easier to apply to help kickstart their research efforts. Additionally, these labels are standard in media and financial reporting, thus making it easier to communicate your focus to a broader audience.

E-Bike Example

For example, consider that you want to start a venture to offer repair services to e-bike owners. You recently purchased one and started using it to commute to work in NYC. While you know how regular bikes operate and how to maintain them, you quickly realize that e-bikes have different maintenance and repair requirements. You start looking for a local repair shop specializing in e-bikes to no avail. Finally, you hypothesize that there is a gap in the market and that a new opportunity has presented itself.

A preliminary industry analysis will help you understand the e-bike market's current state and associated repair services. Caveat. This sample analysis is abbreviated to show you special issues to address in your research. You must build on these steps to understand the marketplace robustly.

Bicycle Retail & Service Sector Classification

Start with the NAICS industrial category system as a foundation. You quickly realize that this specific service area may cut across a few industrial classifications. Using a Google search for the code for e-bike repair and service brings you to the category: Retail Trade (45) sector, sporting goods, hobby, & musical instrument stores (45111), and finally, Sporting Goods Stores (451110). Quite frankly, not that helpful yet. But if you continue to drill down and cross-check with the SIC code system, the preceding national code system, you will narrow down to Sporting Goods and Bicycle Shops (SIC 594100). You know that approximately 12K U.S. businesses are in this classification. If you narrow it down to Bicycle and bicycle parts (59419902), you have narrowed down the potential U.S. establishments to 7.4K. Now, you can estimate the number of U.S. businesses selling bicycles and components. However, you don't know how many of these 7.4K also do repairs (and you have no idea if they repair e-bikes).

You may feel like you are making limited progress, but there is another path to explore. Establishments primarily repairing bicycles are in the Services, Industry SIC 7699 classification. Here you drill down to bicycle repair shops (7699090). There is 340 business in the U.S. classified in this category. You must remember that companies self-type, so one assumption is that many of the 7.4K retail bicycle shops offer some service. So you can be sure that more than 340 enterprises provide bike repair services. The data becomes less reliable as you move down the sub-code categories. The fact that businesses self-identify the classification leads to these data inconsistencies. The NAICS analysis gives you some top-down numbers, but you must be careful how you interpret the data.

If you search bicycle repair shops in New Jersey using a basic Google search, you find 116 such establishments. Many of these 116 repair shops include many sporting goods stores, so it is difficult to determine how many offer essential repair services. However, if you run a specific search for e-bike repair and maintenance using Google Search and cross-reference with Yelp, you will find a list of around 40 e-bike repair businesses in N.J. Now you have a starting database for discovery research and competitive analysis. At this point, I would create a database of these 40 e-bike repair locations and investigate their services in detail.

Step 2. Researching Historical Growth Trends

One of the first things you want to understand is the current business, including any essential historical data, recent patterns, and information that helps gauge the industry's future outlook. In our example, you certainly want to validate that the retail e-bike trade is growing instead of declining. For instance 2017, 263K e-bikes were sold in North America. According to a Deloitte report, E-bikes sales continued to rise in 2018, with over 400K sold. In addition, the NPD Group reported U.S. e-bike sales in 2018 were up 79% from 2017, estimating a $143 million market. According to Mordor Intelligence, the North American market might grow at a CAGR of 12.51% over the next five years. You also see impressive growth globally. The global e-bike market was valued at USD 23.89 billion in 2020 and is expected to reach USD 47.68 billion by 2026.

As part of this analysis, you will also want to compare the e-bike growth trends with the bicycle industry. This additional information is highly relevant since customers purchasing and enjoying traditional cycling may be prime candidates for e-bikes and associated services. Consumer behavior regarding traditional bicycles (and relatively possibly stationary exercise bikes) will strongly indicate your available market. In recent comparisons, the latest figures (NPD) show a growth rate for electric bicycles of 240% in the 12 months leading up to July 2021, with non-electric bicycles growing by 15%. Before that, sales of e-bikes grew 145 percent in 2020 compared to 2019, outpacing sales of all bikes, which were up 65 percent. E-bikes are one of the significant growth trends in cycling.

While your competitive analysis will focus on repair services, you must follow and understand what is happening across the manufacturing and retail landscape. You will want to follow the most popular brands and emerging e-bike manufacturers that may sell or distribute in your region.

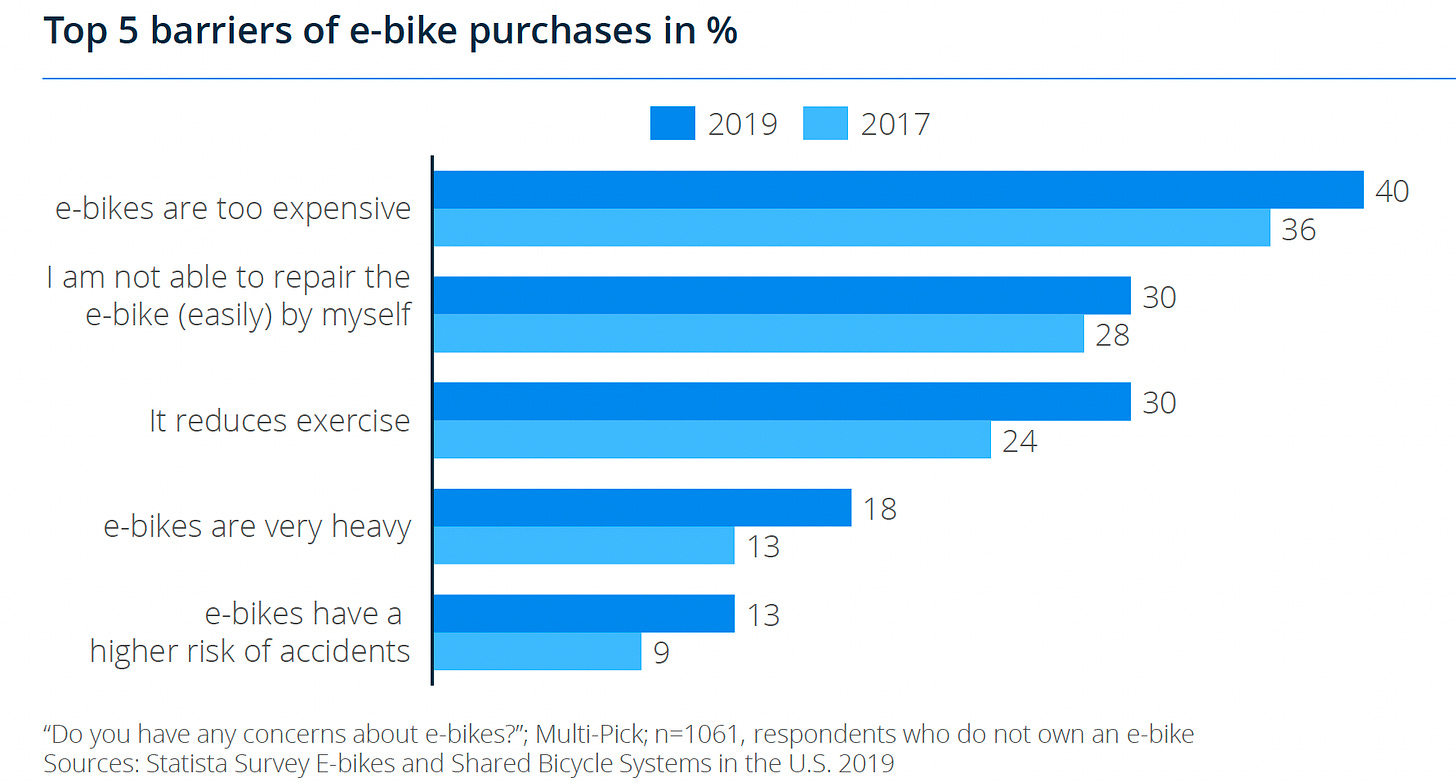

As part of growth trend analysis, you want to look for secondary patterns that might influence industry performance. One specific pattern in the bicycle industry is the growth of the direct-to-consumer business, moving bike sales outside of the traditional local bike shop. In general, there is a growing emphasis on direct-to-consumer brands. Bicycles and e-bike D2C brands are following this growth trend. One of the significant trends in this market is the growth of direct-to-consumer brands, most notably Rad Power Bikes and Aventon. These D2C brands are popular and show strong growth in the U.S. market. Developing this segment is essential for an entrepreneur looking to build an e-bike service business. Most of these companies ship e-bikes that are partially assembled and, even post assembly, need a thorough inspection before road-ready. While the companies claim they are almost ready to go "out of the box," so far, that seems valid. One of the main reasons people avoid purchasing e-bikes is the concern about the assembly and the inability to do the repairs themselves.

This historical analysis is an integral part of your overall analysis. However, it would be best to be careful, as there is conflicting information. For example, you can not accurately assess the time evaluated, the applicable geographic regions, differences in data collection methods, etc. So I advise you to discover a few credible sources and compare the results to ensure you build good facts to support planning decisions.

Step 3. Monitoring Technology Advances

Anything you should know about e-bike technologies, anything that might impact the repair business? As a product category, e-bikes are a hotbed of innovation. As a result, many technical enhancements are driving e-bike sales and usage. Here is a couple to consider in your analysis.

One of the core areas of innovation is recent advancements in lithium-ion battery technology. The batteries are becoming more powerful while shrinking in overall size and weight. These battery advancements will allow cyclists to go longer distances on a charge and make the bikes themselves lighter - both vital product attributes. Some experts predict that e-bikes featuring lithium-ion batteries will account for about 60% of all e-bikes sold in 2023. While these advancements will continue to drive sales, e-bike service businesses will need to deal with the recycling of these larger batteries. Recycling these E.V. batteries can be seen as an additional business opportunity. Companies are already working to create a "closed-loop" supply chain for E.V. battery materials. In other words, collect the old battery and recover a substantial percentage of the waste materials.

Anyone who has ever studied the history of bicycles will recognize a familiar pattern where innovation tends to advance in design. The first bicycles were designed based on known transportation modes. The first bicycles were perceived as an extension of walking, and you never had two feet off the ground. E-bikes are still mostly modified bicycles, and current designs must catch up with many technological advances. As this evolution continues, the extra power and speed will take a toll on e-bike components, thus increasing the need for parts replacement and service.

Generally, I suggest that founders look at current patent activity using the USPTO or Google Patents search engines. For example, a quick search on electric bicycles yielded over 80K patents filed in 2021. Patents ranged from new child seats to public charging stations. Suppose you fine-tune the search for electric bicycle repair. In that case, you have 4.5K patent filings, with many directed toward battery innovations, more robust and lighter frames, and motor hub covers designed for easy maintenance.

Founders can learn a great deal by reviewing patent activity. Besides knowing what new technological advances may be on the horizon, you see who drives the industry's innovations. There can be plenty of surprises with these filings as companies not recognized for the product in question are filing several patents in the area, signaling some strategic interest. For example, Yamaha, better known for its motorcycles, led many e-bike leaders, filing 15 patents in 2020. One patent shows their interest in new bike frame configurations that optimize battery placement on the bike for both aesthetics and battery maintenance.

Step 4. Identifying Supply Chain Issues

As with many industries, we have become aware of how fragile our global supply chains have evolved, exacerbated during the pandemic. The increase in e-bike interest has exploded during the pandemic, even with problems with lithium batteries and other component shortages. Additionally, most bicycle components come from outside the U.S., thus causing further supply shortages and increased shipping costs. As a retailer or service provider, there will be a need to monitor supplier shutdowns, containers in jammed ports, semiconductor shortages, and skyrocketing shipping expenses. You must carefully plan and manage parts inventory as a repair service business.

Step 5. Conducting PESTLE and Secondary Trend Analyses

Launching a startup in today's dynamic business landscape requires diligent market research to identify opportunities, anticipate challenges, and make informed decisions. Entrepreneurs often use strategic tools like PESTLE analysis to understand the external factors influencing a startup's success. This analytical framework allows startups to evaluate the political, economic, social, technological, legal, and environmental factors shaping their target markets.

Utilizing a PESTLE analysis as part of startup market research provides entrepreneurs with a comprehensive view of the external factors that can impact their business. This analytical framework helps identify opportunities, anticipate challenges, and make informed decisions based on the political, economic, social, technological, legal, and environmental landscape. By leveraging PESTLE analysis, startups can develop tailored strategies that align with market dynamics, ensuring long-term success and sustainability in a competitive business environment.

Political Factors

Political factors encompass the influence of government policies, regulations, and stability on a startup's operations. By analyzing political trends, startups can identify potential risks, such as changes in tax laws, industry regulations, or government incentives. Understanding political factors allows entrepreneurs to adapt their strategies and mitigate potential challenges while leveraging opportunities emerging from political developments.

Economic Factors

Economic factors include economic growth, inflation, interest rates, and consumer purchasing power. Startups must evaluate these factors to determine the financial viability of their business model, pricing strategies, and target market. An in-depth analysis of economic trends can provide valuable insights into market demand, consumer behavior, and the overall economic climate, allowing startups to tailor their offerings and strategies accordingly.

Social Factors

Social factors are cultural, demographic, and societal aspects that impact consumer behavior and preferences. Startups must understand the social trends, lifestyle choices, and attitudes of their target market to position their products or services effectively. By examining social factors, entrepreneurs can gain insights into changing consumer needs, emerging trends, and cultural shifts, enabling them to develop more relevant and appealing offerings.

Technological Factors

Technology is pivotal in shaping markets and industries in today's digital age. Startups must assess technological advancements, innovation, and disruptive trends within their industry. Understanding technical factors helps entrepreneurs identify opportunities for leveraging technology to create competitive advantages or anticipate threats posed by emerging technologies. This analysis enables startups to align their business models with technological developments and harness them to drive growth.

Legal Factors

Legal factors encompass laws, regulations, and compliance requirements that govern business operations. Startups must know industry-specific regulations, intellectual property rights, data protection laws, and other legal considerations. Conducting a PESTLE analysis helps entrepreneurs identify any legal barriers or potential risks associated with their business activities, ensuring compliance and avoiding legal issues in the long run.

Environmental Factors

Environmental factors focus on sustainability, climate change, and ecological impacts. Startups need to incorporate environmentally friendly practices into their operations. By evaluating environmental factors, entrepreneurs can identify opportunities for eco-friendly innovation and assess the potential impact of environmental regulations on their business. Understanding these factors enables startups to develop strategies that align with sustainable practices, attract environmentally conscious consumers, and reduce their ecological footprint.

In general, a couple of trends impact the continued growth of e-bikes. First, there is a growing trend where consumers and businesses alike want to use their cars less to support the environment. For consumers, e-bikes have become an option to replace driving in specific cases, like short shopping trips and commuting. The main reason for this is that e-bikes have much fewer carbon emissions associated with their manufacturing process than much larger electric vehicles. Additionally, the economic costs of maintaining an e-bike are less than electric automobiles.

This focus on sustainability goes beyond consumer use as companies looking to go green are exploring ways to transport goods and people in more sustainable practices. For example, urban delivery and courier services use e-bikes at an increasing rate. In addition, as commercial usage grows, demand for more repair and maintenance services will increase.

On the political front and also driven by environmental concerns is the creation of the bill introduced in the House of Representatives to provide refundable tax credits for 30% of the cost of qualified e-bikes. However, the tax credit is limited to $1,500 per taxpayer, less all credits allowed for the two preceding taxable years. A suitable electric bicycle is a two-wheeled vehicle that is, among other things, equipped with an electric motor of fewer than 750 watts that is capable of propelling such a vehicle. This Electric Bicycle Incentive Kickstart for the Environment Act, or the E-BIKE Act, is an example of how political actions can impact one's industry, in this case, positively.

Additionally, like New York, many states are looking at new regulation strategies to support e-bikes by consumers and businesses. For example, New York has recently legalized e-bikes heavily used by food and other delivery services. If you are in the retail or service e-bike business, you must monitor the outcomes of these regulations. A positive scheme will increase e-bike sales for delivery workers, urban commuters, and e-bike ride-sharing companies.

Step 6. Identifying Recognized Domain Experts | Influencers

As you continue to research, you will repeatedly find specific sources quoted by other sources. Frequency citations should provide some evidence of credible information. For example, several well-established media outlets provide cited data from NPD. In addition, Dirk Sorenson is a well-respected industry analyst in The NPD Group's Sports practice, covering the bicycle, outdoor, and team sports equipment categories.

Many well-known bloggers, youtube stars, and journalists focused on this industry. Finding a list of top influencers and blog sites was easy as I looked. You need a strategy for what you want from a specific influencer, ranging from knowledge to advocacy. I suggest having particular goals for why you may want to follow and engage specific individuals.

When following essential events, experts, and influencers in any industry, I would be remiss if I did not mention "Google Alerts ." This Google free service lets you create email notifications of specific topics using associated keywords. I am always surprised when I ask students who use it to discover that most have not heard of it. Alerts is a handy research tool that lets you stay on top of current events through web and social media articles. For our e-bike example, I suggest creating alerts for "e-bike," selecting major e-bike manufacturers, and prioritizing industrial analysis and influencers. Additionally, for e-bike repair, you can add competitors you identify as essential to watch.

Step 7. Updating Your Understanding of Competitive Landscape

Understanding the competitive landscape is a critical element of any industrial analysis. In earlier posts, I addressed the steps to conduct robust research on individual direct and indirect competitors. First, you will want to create a database of all significant direct and indirect competitors. This initial listing will be the foundation for subsequent competitive analysis. In our example, direct competitors will certainly include bicycles and e-bike retailers with direct repair services on-premise and mobile bike repair enterprises. In addition, the indirect competition has "Do It Yourself" resources such as youtube channels dedicated to e-bike repair.

We know from our earlier industrial classification work that approximately 116 potential bicycle retailers provide repair services in New Jersey, 40 of which have customer reviews specifically about repair work. So as a starting point, you will want to create a table that outlines the salient business model elements for each of the 40 service businesses initially identified. In this analysis, as I have suggested before, you are not just focusing on the specific product offerings, in this case, repair services, but all aspects of their business model. For example, where do the repairs take place? There are several options to explore, especially with e-bikes heavier than most traditional bicycles. Does the competitor do all the repairs at their location? Do they offer e-bike pick-up? Do they have mobile repair services where they come to the customer's location? The detailed analysis of competitors' business models will help identify potential gaps in the marketplace for you to exploit in new innovative ways.

Mastering Competitive Analysis: A Step-by-Step Approach for Entrepreneurs & Innovators

Introduction Studying your competition is an ongoing pursuit in the entrepreneurial context. It is not something you do sporadically. You identify and monitor all significant and emerging competitors throughout the venture realization process. You determine their strengths and weaknesses and consider how they will react to every one of your strategic moves. What some call competitive intelligence will be an ongoing process for you as an entrepreneur and business owner.

Startup Ecosystem Analysis

In addition to understanding their target industry, it is equally crucial for startups to thoroughly evaluate the surrounding entrepreneurial ecosystem, which can profoundly impact their success. This ecosystem comprises diverse components, including accessible advisors, robust support networks, educational programs, research capabilities, funding sources, professional service providers, human capital, quality infrastructure, and influential founders and ventures.

Assessing the local ecosystem landscape provides invaluable visibility into the external resources, partnerships, talent pools, community, and potential challenges that founders may leverage or overcome. Entrepreneurs gain strategic insight by analyzing areas such as the strength of advisor and mentor networks, education and research institutions, coworking spaces, accelerator programs, active investors, startup talent dynamics, legal and accounting services, broadband connectivity, and successful startup role models. They can pinpoint strengths to capitalize on, such as abundant funding and collaboration opportunities and gaps that may need to be proactively addressed by stakeholders.

Developing a detailed understanding of the surrounding startup ecosystem enables entrepreneurs to make informed strategic decisions about leveraging regional resources, forge meaningful partnerships, attract talent, and overcome potential hurdles to startup success. It also illuminates where the broader community could benefit from more robust support and infrastructure to unlock the fullest potential of local startups.

Advisors

Advisors play an invaluable role in the startup ecosystem by contributing their expertise, experience, and guidance to founders and early-stage ventures. These individuals possess highly relevant industry-specific knowledge, business operations experience, financial acumen, marketing skills, and other competencies that aspiring entrepreneurs can tap into. Advisors assist with critical activities like developing business models, creating strategic plans, making meaningful connections, and navigating partnerships. Startups must align with advisors who deeply understand their market landscape and needs. An advisor with decades of experience in a particular industry can provide tailored insights on market trends, customer segments, competitive dynamics, and capital-raising strategies. They can also introduce critical players across the startup's target industry.

By leveraging the know-how of trusted advisors, founders can avoid common pitfalls and accelerate progress. Advisors mentor entrepreneurs through significant milestones like ideation, product development, fundraising campaigns, and company growth. Quality advisors actively ask thoughtful questions, review plans, and have regular check-ins to keep founders accountable. They draw from their networks, connections, and past experiences to open doors and uncover opportunities. The most effective advisor relationships are grounded in transparency around expectations, alignment on vision and values, and a commitment to the startup's long-term success.

Maximizing the Value of Startup Mentors & Advisors

Introduction Startup founders often seek advice for a variety of reasons. By tapping into the expertise of various individuals, they gain valuable insight and advice on navigating the challenges and uncertainty of starting and growing a business. In addition, founders gain support and encouragement as they work to bring their ideas to life and overcome obstacles. Moreover, advisors can provide invaluable lessons learned and best practices, connections, and introductions to potential customers, partners, and investors. Finally, experienced individuals can provide a sounding board for ideas and strategies and help founders think through tough decisions by giving constructive feedback. In short, startup mentors and advisors can be a precious resource for founders looking to gain the knowledge, guidance, and support necessary to build and grow their businesses.

Support Networks

Access to robust support networks is vital for founders and startups across all stages of growth. These networks include like-minded entrepreneurs, industry professionals, program managers, and ecosystem builders who connect, collaborate, and celebrate startup innovation. Support networks include local meetup groups, university entrepreneurship centers, startup incubators and accelerators, industry conferences, and digital communities. Each provides unique value to founders and ventures. For example, by attending startup-focused meetup events, entrepreneurs can expand their network, meet potential co-founders, identify business partners, and build an early customer base. Startup accelerators and incubators like Y Combinator enable founders to work alongside peers to rapidly develop and iterate on their businesses through structured programming over months. Unlocking the opportunities within these supportive communities can profoundly enrich and strengthen any entrepreneurial journey.

Support networks offer more than just connections to people. They also provide access to physical spaces, events, capital, and programming tailored to the needs of new ventures. Hackathons unite developers to collaborate intensively on building new products over days or weekends. University entrepreneurship centers run pitch competitions and workshops to cultivate skills. Coworking spaces offer affordable office infrastructure where founders can work shoulder-to-shoulder and derive inspiration from other entrepreneurs. Quality support networks create communities and experiences where startups can genuinely thrive if they actively engage.

Education & Research

Robust entrepreneurial education opportunities and market research capabilities are invaluable assets within a startup ecosystem. Higher education institutions play a lead role through degree programs, courses, and workshops focused on new venture creation and management. For example, taking university classes in entrepreneurship exposes students to core concepts around opportunity recognition, business model development, fundraising, marketing, and leadership. These courses often incorporate practical elements like ideation exercises and business plan creation. Those looking to immerse themselves further can participate in degree programs like an MBA in Entrepreneurship to gain advanced training. Emerging models like startup boot camps offer intensive short courses outside traditional universities. These programs provide immersive training on launching new tech ventures.

Beyond formal instruction, research capabilities help strengthen the ecosystem. Market research firms and university centers focused on producing industry reports and data uncover valuable insights on market trends, opportunities, customer segments, and competitive benchmarking. By tapping into quality research resources, founders can make strategic decisions backed by data-driven market insights. For example, understanding historic venture capital investment patterns across different startup verticals can inform how a founder approaches fundraising. Having a pulse on emerging technologies, shifting consumer attitudes, and regulatory changes ensures startups remain aligned to capitalize on what's next. Robust education and research capabilities empower founders with the knowledge and insights to build differentiated, high-growth new ventures.

Funders

Securing startup funding is foundational, and a strong presence of diverse funding sources provides the capital entrepreneurs need to transform ideas into reality. Ecosystem funding players include angel investors, venture capital firms, equity crowdfunding platforms, and government grants. Each type of funding source has unique expectations, funding stages, due diligence processes, and benefits. Angels invest their wealth, often provide hands-on mentoring, and take an early stake in promising ventures. Prominent angel groups can have extensive networks to leverage. Venture capitalists manage pooled funds from institutions or wealthy individuals to invest in scaling startups, usually in return for equity and board influence. V.C. firms also actively support portfolio companies through guidance and connections. Equity crowdfunding opens up startup investing to the public, enabling founders to raise smaller chunks of capital from many backers. Government agencies offer non-dilutive grant funding targeted for goals like economic development or cleantech innovation.

When assessing the funding environment, founders should understand the types of startups funders specialize in, typical check sizes, equity levels taken, and involvement expected following investment. For example, while accelerators may offer small seed rounds to very early-stage companies, prominent V.C. firms likely seek more mature startups with proven traction. The presence of active angels, early-stage V.C.s, and seed funds ensures entrepreneurs have capital access at all stages of maturing their ventures. Beyond providing necessary capital, experienced investors can accelerate startup success through their networks and sage advice. A robust funding landscape allows founders to choose the best partners aligned with their startup's maturity and sector.

Professional Services

Access to reliable, professional services is critical to a thriving startup ecosystem. In the early stages of business formation, founders must navigate complex legal processes and regulatory frameworks covering incorporation, intellectual property protection, and employment policies. Working with business-savvy legal counsel helps entrepreneurs make sound decisions establishing the legal foundations of their ventures based on factors like equity splits, investor rights, and compliance obligations. On the financial side, accounting firms help structure bookkeeping, payroll, taxes, and reporting to meet legal and investor expectations. For technology startups, capable patent lawyers can assist with I.P. filings to protect inventions. Down the line, H.R. consultants assist rapidly scaling startups to refine their organizational structures, hiring practices, and employee policies as the team expands.

Beyond essential services like legal and accounting, other specialists provide vital strategic and operational support. Marketing consultants lend expertise in identifying target customers, craft positioning and messaging, and go-to-market. User experience designers optimize digital interfaces to drive user adoption and retention. Operations consultants assess processes and supply chains to maximize efficiency as startups scale. The availability of seasoned experts for hire in these critical areas allows founders to focus intensely on the core business while leveraging specialized skills and experience to execute excellently. Given the broad spectrum of complex needs facing startups, access to high-caliber professional services streamlines success.

Human Resources

A talented and motivated workforce powers startups, so a thriving entrepreneurial ecosystem cultivates and retains skilled human capital. Many startups emerge from university communities that represent dense talent pools. Ecosystems benefit from campus events connecting students to startup jobs and internship opportunities for smooth access to graduates. Founders may recruit more experienced professionals locally or attract them to relocate through professional networks and startup scene visibility. Industry conferences held in startup hubs also enable recruiting.

Government policies and programs play a role in talent development and retention. Friendly immigration laws allow founders to recruit globally. Initiatives like the Startup Visa program expedite visas for foreign founders building U.S. startups. Shared workspaces help retain talent by fostering community. Robust STEM education and training programs generate skilled technical workers. Internship initiatives create startup exposure for students. Stock option pools incentivize teams to forgo stability for startup equity upside. By collectively fostering a vibrant culture of innovation, ecosystems cultivate passionate talent inspired to join cutting-edge startups.

The smooth human capital circulation between startups, corporations, and investors represents a dynamic ecosystem. A dense landscape of startups creates abundant openings for those with startup experience to hop between emerging ventures. Large tech employers spawn experienced alumni into the startup ecosystem. Investors and advisors move talent across their portfolios. Shared events and networks enable this circulation. A depth of cloud, A.I., and other technical talent spurs startups in aligning industries.startup-aligned skill development positions ecosystems for ongoing human capital availability. With deliberate nurturing by stakeholders, ecosystems become magnets for exceptional talent to create and grow future-shaping companies.

Business Infrastructure

Quality business infrastructure fundamentally empowers startups to focus on customers and growth. Coworking spaces offer affordable, flexible office environments that foster founder collaboration and inspiration. Campus incubators provide subsidized workspaces paired with programming and mentorship. Hackerspaces give developers 24/7 access to high-end equipment like 3D printers to innovate. Shared machine shops offer startup-friendly equipment rentals. Events venues enable easy meetup organizing. Universities supply libraries, labs, and data centers critical for research and innovation.

Reliable high-speed internet, cloud platforms, business productivity software, and cybersecurity represent essential digital infrastructure. Dynamic websites and workflow management tools allow scrappy teams to project professionalism when interfacing with partners and customers. Robust broadband connectivity prevents delays in accessing cloud services and transmitting time-sensitive data. Cybersecurity solutions help mitigate vulnerabilities arising from thin early-stage resources. State and local governments can encourage growth by streamlining business licensing, providing tax incentives, and funding infrastructure upgrades to attract startups.

The well-designed physical and digital infrastructure allows startups to punch above their weight in building innovative products, serving customers, and competing for talent. Simple operational efficiencies like paperwork automation and fast internet relieve countless headaches. Access to cutting-edge labs and equipment unlocks complex technical innovation. Thoughtfully nurturing supportive infrastructure across the ecosystem reduces founder hurdles at all stages of the startup lifecycle.

Influential Founders & Startups

The presence of standout founders and high-growth startups within an ecosystem catalyzes further development through inspiration and accumulated know-how. As shining examples of what is possible in the region, influential founders and rocket-ship startups generate excitement that rallies and attracts other entrepreneurs. Their journeys demonstrate how to translate raw innovation into exponential business success and value creation. Up-and-coming founders study their playbooks to compress their learning curves.

These standout founders and startups attract greater interest from investors, technical and business talent, corporate partners, and industrial players. This condition strengthens density and linkages across the ecosystem. Investors eagerly seek to back founders with proven startup success and leverage their expertise across portfolios. Talented resources work alongside respected founders and cutting-edge startups advancing innovation. Corporations pursue partnerships with rising startups disrupting convention. The positive momentum these standout founders and startups create elevates the ecosystem.

The business insights, personal networks, and reputational capital amassed by successful founders accumulate exponentially. A founder who previously built a unicorn startup has invaluable credibility and connections to pay forward across their next ambitious venture. Serial entrepreneurs continually channel lessons learned into ever-rising ventures. Their journeys trace an escalating flight path for the broader startup ecosystem. Even beyond directly supporting emerging founders, standout founders are luminous inspirations in unlocking the next phase of an ecosystem's potential.

By thoroughly examining the diverse components that enable entrepreneurship within a region, founders gain an intimate understanding of the broader environment surrounding their startup. From accessible expertise to critical infrastructure, each element of the ecosystem impacts new venture success. Conducting in-depth assessments of advisor networks, support systems, research capabilities, funding sources, services, human capital dynamics, infrastructure quality, and role model startups illuminates avenues to leverage strengths and shore up weaknesses. Armed with insights into resources to activate and gaps to fill, entrepreneurs can make strategic decisions to maximize their startup's odds by aligning with the realities and possibilities of their surrounding ecosystem. While broader conditions impact outcomes, true entrepreneurial success also requires actively engaging the ecosystem rather than passively coexisting within it. With informed strategic adaption, hunger for opportunity, and relentless drive, founders can still build stellar companies even within imperfect ecosystems.

Sidebar: Applying Market Analysis Frameworks for Geographic Expansion

When considering expanding your business into new geographic markets, the industry analysis, ecosystem evaluation, and Minimum Viable New Market Entry (MVNME) frameworks can be constructive in making well-informed decisions.

Industry Analysis: Take a close look at the industry in the new geographic market, paying attention to regional trends, growth patterns, the competitive landscape, and any regulations that may affect your business. Identify the key players in the market, potential partners, and local market dynamics to determine if your product or service will succeed in the new location. Don't forget to consider market size, customer preferences, and pricing strategies specific to the region. This information will help you tailor your approach and adjust your offering to suit the local market better.

Ecosystem Evaluation: If your business is in the growth phase, assessing whether the marketplace ecosystem in the new geographic region can support your continued expansion is essential. Look at the target market's size, demographics, and purchasing power to see if there's enough demand for your product or service. Find out about existing distribution networks, logistics infrastructure, and potential partners that can help you reach your target customers effectively in the new market. Consider the availability of skilled workers in the region, especially those with industry-specific expertise, to ensure your business can continue to grow and operate smoothly. Learn about the local regulations, including industry-specific rules, business licensing requirements, and tax implications that could affect your operations. Lastly, evaluate local competitors' strengths and market positioning and look for gaps or opportunities to set yourself apart. By looking at these factors, you can determine if the new geographic market has the necessary ecosystem components to support your business's growth and success.

MVNME Approach:

When expanding into a new geographic market, consider applying the MVNME framework to minimize risk and validate market fit.

Start by defining your target market and adapting your value proposition to meet the new market's needs.

Prioritize a beachhead market segment for initial entry and develop a minimum viable offer to test market responsiveness.

Leverage existing assets and partnerships to minimize costs and optimize resources.

Create a focused test marketing plan with clear metrics and execute agile experiments to validate assumptions.

Be prepared to pivot and reevaluate based on market feedback and establish clear criteria for scaling up and expanding to broader market segments based on traction and product-market fit.

PESTLE Analysis: Conduct a PESTLE analysis to evaluate the political, economic, social, technological, legal, and environmental factors specific to the new geographic market. This analysis will help you identify potential risks or opportunities and determine what changes you must make to navigate the local business landscape successfully. For example, consider the political climate, government policies, and upcoming elections that could impact your business. Assess the economic conditions, such as GDP growth, inflation rates, and consumer spending habits. Look at the social and cultural aspects, like demographics, consumer preferences, and lifestyle trends. Monitor technological advancements and infrastructure that could affect your operations or provide new opportunities. Consider legal considerations like labor laws, intellectual property rights, and consumer protection regulations. Finally, consider environmental factors critical to your business or customers in the new market, including climate conditions, natural resources, and sustainability practices.

Using these frameworks and approaches, you can make data-driven decisions about market entry strategies, product localization, partnership opportunities, and resource allocation when expanding into new geographic territories. Thorough research and analysis, combined with a focused and agile approach to market validation, will help you take advantage of regional growth opportunities while reducing potential risks associated with entering a new market.

Conclusion

By diligently leveraging frameworks like industry analysis and startup ecosystem evaluation, founders gain strategic insights into the market landscape and support structures surrounding their ventures. Developing a comprehensive understanding through robust research provides a critical context for identifying high-potential opportunities, recognizing risks requiring mitigation, and making well-informed decisions.

However, the analysis represents only one aspect of creating startup success. Entrepreneurs must complement research-backed planning with agile execution, continuously engaging customers, responding to market shifts, and refining strategies based on real-world feedback. Room must also be left for experimentation, iteration, and innovative thinking to disrupt the status quo.

Building a thriving, sustainable startup requires a balanced blend of practical, data-driven planning and adaptive creativity. By tempering analytical diligence with visionary risk-taking, founders can respond decisively when the moment suits a breakthrough. With focus, perseverance, and passion, innovators can transform any idea from concept to reality and scale into an impactful enterprise.

Though the entrepreneurial journey is filled with twists, turns, and uncertainty, arming yourself with deep knowledge of your industry ecosystem provides a strategic compass to navigate whatever lies ahead. By making choices informed by research yet guided by instinct, resourcefully leveraging regional strengths while addressing gaps, and executing with excellence, founders can build ventures that deliver value and stand the test of time.

Keep reading with a 7-day free trial

Subscribe to Innovate & Thrive to keep reading this post and get 7 days of free access to the full post archives.