Bridging Startups to Equity Capital: Incubators, Accelerators and Studios

Guiding Startups to Funding.

Introduction

Securing funding is a pivotal challenge facing early-stage startups before they can scale. While traditional venture capital is crucial in providing growth equity to fund expansion, most emerging ventures must establish viability and traction first. Non-dilutive sources allow entrepreneurs to iterate without relinquishing control in fledgling stages.

Incubators, accelerators, and venture studios have evolved as ecosystem enablers, filling this pre-seed funding gap through differentiated approaches. These startup assistance models help ventures transform from fragile ideas to investable companies by matching business-building resources to current needs and founder risk preferences.

This article examines how incubators, accelerators, and venture studios provide complementary support across the startup lifecycle. The goal is to equip entrepreneurs to understand the tradeoffs around programming, equity involvement, and incentives offered. Mapping assistance options to the developmental stage allows founders to access specialized resources, bridging viability to venture capital.

Tailoring flexible incubator guidance, intensive accelerator growth catalysts, and hands-on studio creation to current gaps elevates ventures’ odds of securing requisite funding and expertise at each phase without premature equity exposure. Partnerships across models aligned to evolving requirements help startups remain optimally fueled.

Supporting Early-Stage Ventures: Incubators

Incubators are programs dedicated to helping early-stage ventures transform concepts into companies during the most precarious phase - transitioning from ideation to validated prototypes and initial customers. By providing flexible workspaces, connections to resources, and startup-focused guidance in exchange for little or no equity, incubators empower entrepreneurs to establish solid foundations before needing significant external capital investment. Selecting the right incubator partner aligned tightly to the current status and objectives can pay invaluable dividends.

Defining Incubators and Their Focus

Startup incubators aim to support early-stage startups without taking any equity in the fledgling companies. Incubators help founders during the most vulnerable phase - developing minimum viable products, validating ideas, and establishing initial traction. For example, an academic incubator might provide lab space and business mentors to help a bioengineering startup test prototypes and refine its technology.

Unlike accelerators which focus on rapid growth and scaling, incubators emphasize sustainability and preserving founders' ownership. The goal is to give startups time and space to turn ideas into prototypes, acquire first customers, and reach a point where they can raise external investment. An incubator might help a medical device startup make connections for clinical validation studies rather than push for quick expansion into multiple markets.

Common Incubator Hosts and Funding Sources

Incubators are hosted and funded by various organizations with different objectives. Academic institutions like universities often run campus incubators to support student and faculty entrepreneurs through subsidized spaces and networking events. Economic development agencies utilize incubators to encourage local business formation and job growth. Coworking spaces and innovation hubs integrate incubator-like programs offering pitch coaching and mentors. Major corporations operate incubators to connect with emerging technologies relevant to their markets - for example, Target's retail-oriented incubator assists consumer product startups. Government grants and public-private partnerships help sustain these incubator models, while private sponsorships like corporate and angel investor funding enable tailored programs catering to strategic startup sectors.

Key Offerings and Support Models

Rather than intensive cohort-based programs, incubators take a longer-term, flexible approach to providing support. An entrepreneur might engage with an incubator periodically for specific advisory services rather than committing to a structured multi-month curriculum. Typical offerings include subsidized office/lab spaces where ventures can cluster, regular networking gatherings and pitch events to build connections with relevant mentors based on each startup's needs, and training sessions on funding alternatives. For instance, a clean energy incubator might organize a monthly investor panel, biannual grant application workshops, and open desk space options.

Access to Early Capital and Fundraising

While not direct equity investors themselves, incubators play an invaluable role in helping startups secure pre-seed funding and non-dilutive grants. Many incubators organize periodic pitch events and demo days where ventures present prototypes to angel investors and impact funders to generate interest for early fundraising. Others facilitate applying for Small Business Innovation Research (SBIR) and other government innovation grants by providing technical assistance and reviews. Partnerships with academic incubators open up funding streams like university prototype development funds. Hands-on mentorship helps founders hone pitches and optimize funding and traction strategies during the incubator program.

Evaluating Incubator Fit

Choosing the right incubator is a significant decision for early-stage startups to set their venture up for success. Before committing, entrepreneurs should thoroughly assess alignment across a few key dimensions:

Defining Goals and Stage. Founders should start by clearly outlining their startup's core objectives, current developmental stage, and specific resource gaps in funding, mentors, infrastructure access, or networks. This self-awareness of status and needs allows screening incubators for fit accordingly. An idea-stage startup still proving basic viability with prototypes has vastly different requirements than a venture ready to scale production and take on external capital.

Assessing Offerings. With clarity on startup priorities, research incubator offerings, mentors, and successful alumni ventures that indicate the program's ability to address your venture needs. Consider details like time commitments required, flexibility around the utilization of resources, and networking opportunities tailored to the business stage and sector. Location, program duration, and cohort dynamics also impact access and peer support. For example, an e-commerce startup may gravitate towards urban tech incubators with targeted e-commerce expertise versus generalized regional programs.

Assessing Partnership Value. While incubators provide significant intangible value through guidance, credibility, and networks without taking equity, founders should evaluate potential dependence downsides and opportunity costs. Though rare, some incubators mandate future revenue sharing if a venture achieves certain milestones. Carefully determining if the tangible and intangible resources ultimately accelerate progress more than any constraints warrant is vital. Re-evaluating fit allows for reconciling evolving startup needs over long-term agreements.

Re-Evaluating Fit. Even after starting a program, founders should continually re-evaluate if the incubator continues providing appropriate resources as startup priorities pivot or if they pass natural lifecycle milestones. Proactively communicating changing needs to incubator leadership allows realignment or graduation if outgrown.

Selecting an aligned, high-touch incubator provides immense benefits in accelerating ventures. Still, intentional matching based on defined objectives, stages, and evolution ensures startups extract the maximum value from these foundational partnerships. The incubator ecosystem provides invaluable opportunities to establish startups on solid foundations before needing significant external capital. However, identifying options sharply matched on priorities at the current stage ensures entrepreneurs extract the highest value.

Incubator graduates often move on to accelerator programs for the next growth phase, focusing on rapid expansion and funding. Accelerators complement the incubator foundation by providing cohort-based, milestone-driven support aimed explicitly at achieving funding or profitability milestones within months.

Maximizing Startup Potential: Non-Equity Funding Strategies for Early-Stage Ventures

Introduction This article focuses on non-equity funding sources for startups, aiming to shed light on various options available to entrepreneurs seeking capital. It is essential to understand the funding needs based on the stage of development before diving into discussions about early venture funding. Many founders begin by wondering how to connect with venture capitalists to secure financing for their new enterprise. However, a more astute question to ask is when the appropriate time is to consider venture capital. Interestingly, the reality is that most founders may never be ready for venture capital or other equity-based funds.

Accelerating Growth Momentum: Accelerators

Accelerators support the next stage of startup growth by concentrating expertise and capital to boost ventures with proven traction substantially. By offering intensive mentorship, funding, and access to customers and investors, accelerators aim to hit targeted milestones like a Series A funding round within months in exchange for a small equity percentage. Finding alignments between accelerator specializations and startup needs in both sectors and stages allows founders to leverage these springboards effectively.

Defining Accelerators and Their Focus

Startup accelerators support ventures at a later stage than incubators - after startups have moved beyond the initial product validation and early traction phases. Accelerators aim to supercharge business growth and development for those with proven concepts in exchange for equity. The critical focus is rapidly getting to essential funding, product, or growth milestones - typically culminating in a pitch to external investors.

Whereas incubators emphasize flexibility and sustainability without taking equity, accelerators concentrate on speed and scale, accepting tradeoffs on company ownership. Accelerators typically operate fixed-term cohort-based programs ranging from weeks to a few months. Each cohort works towards staged objectives on an intensive timeline meant to culminate in securing investor commitments for the next startup growth phase. Leading accelerators like Y Combinator, 500 Startups, and TechStars run programs for founders globally to achieve funding and expansion support post-graduation.

Significant hands-on mentorship, training, and networking opportunities support an accelerated timeline toward launch and growth. Subject matter experts across business, technology, and fundraising provide guidance tailored to each venture. Access to partner-level thinking helps founders navigate growth challenges. Extended network connections aim to set startups up for success beyond just the program.

In exchange for turbocharging startup progression, most accelerators take a small equity percentage - typically 5-8%. They also often provide a small amount of seed capital, usually $20,000-$150,000. However, successful accelerated ventures stand to gain investment, credibility, and momentum worth far beyond these upfront costs. Identifying the suitable accelerators aligned to business vertical, stage, and founder priorities is critical to ensuring mutually beneficial partnerships driving ventures rapidly forward.

Common Accelerator Hosts and Models

Various corporations, venture funds, universities, and startup support organizations host accelerators. Corporate accelerators allow large firms to connect with emerging technologies by providing guidance and equity investment to external startups with potential synergies. Venture capital investors use accelerators to identify early investment prospects and build relationship pipelines. Universities aim to commercialize more research via accelerator programs focused on ventures with licensing opportunities. Meanwhile, standalone accelerators like Techstars and Y Combinator fund cohorts to generate returns through equity participation in successful graduates.

Additionally, regional governments and economic agencies sponsor public accelerators as catalytic drivers of local entrepreneurship and technology innovation. State-affiliated programs concentrate on creating viable ventures and high-quality jobs, often involving mentors from regional universities and investor communities. Public accelerators tend to offer broad-based assistance, whereas private corporate and VC-backed accelerators more often focus intensely on startups in sectors of strategic interest.

Core Offerings and Resources

Accelerators concentrate expertise, connections, and infrastructure to boost startups' growth trajectories substantially. The flagship offering is high-touch mentorship from hundreds of subject matter experts in areas like product design, marketing analytics, recruiting, supply chain logistics, and fundraising. Established entrepreneurs and functional leaders lend hard-won operational insights, guiding founders to navigate growth challenges. Tactical coaching on finetuning pitches and positioning also prepares ventures for funding conversations.

Beyond mentor "faculty," accelerators provide connections to channel partners, prospective enterprise customers, and investors aligned to each startup's domain. Curated introductions help validate product-market fit, build sales pipelines, and create demo-day deal flow. Consider an IoT accelerator connecting to manufacturers interested in piloting sensor-enabled process improvements.

Many accelerators also offer office space and programs convening cohorts in central locations, though this is shifting with remote models. Shared spaces allow for informal founder exchanges, building camaraderie and support. Content sessions, guest speakers, and pitch drills aim to facilitate structured learning. Perks like legal, recruiting, and technical services address neglected startup infrastructure needs. The overall intention of integrated programming is to build founder confidence in tackling scaling challenges.

While components vary, accelerator resource programming focuses squarely on customer-funding skill development and mentoring solid relationships to drive tangible startup productivity, as measured through participant satisfaction, funding attained, and survival rates. Keeping founders in the driver's seat while accelerating execution ultimately separates accelerators from more operationally involved venture studios.

Access to Capital Through Accelerators

Unlike incubators, leading accelerators like Y Combinator and 500 Startups make sizeable seed investments between $120-150K in exchange for a 5-8% equity stake in participating startups. The seed capital allows founders to focus on the program duration without immediate fundraising pressures. Investments also indicate accelerator skin in the game.

However, the most significant value accelerators provide is access to follow-on fundraising prospects. Demo days convening hundreds of angel, venture, and corporate investors are the ultimate program culmination points. Pitch preparation refines stories and readies founders for investor conversations. Accelerator mentors leverage their Rolodexes to make qualified introductions to capital partners aligned to respective startup sectors. And the accelerator brand itself serves as a signaling mechanism for ventures meeting selective admission standards.

Data shows that the cumulative percentage of companies raising a round stabilizes after year three in a 50-70% range for top accelerators. This information indicates that most cohorts experience a majority of fundraising by providing startups with adequate investor readiness through programming and network access. Maintaining financing momentum beyond accelerator demo days is crucial, so ongoing founder fundraising preparation and lasting community connections prove pivotal.

Alumni statistics from top accelerators are compelling, with more than 50% of successful graduates still in business after five years. Of course, investors conduct full diligence regardless of accelerator pedigree. However, the degree of investor exposure and brand credibility facilitated by accelerators are impressive, combined with the operational and tactical support in the months leading up to demo days. Establishing fundraising momentum in existing programs can pay dividends in subsequent rounds.

Given their cohort involvement, accelerators frequently provide follow-on investment to promising ventures. Analysis shows that accelerator follow-on startups often outperform non-follow-on peers from the same class. For example, Techstars 2015-2020 follow-ons had a 3.4x value/capital ratio versus 2.3x for the cohort batch. Tighter post-program alignment of incentives explains some performance differentiation.

Tradeoffs around accelerator capital efficiency, equity stakes, and portfolio performance vary across the ecosystem. However, leading programs have honed structures, incentives, and offerings tailored tightly to maximize viable startup output. Finding options curating domain expertise and networks matched to the startup stage and sector pays dividends in capital raised and credibility gained.

Assessing Accelerator Fit

With the proliferation of startup accelerators, finding the right match matters tremendously, given the equity stake and opportunity cost involved for resource-constrained founders. Key dimensions to assess include:

Defining Startup Stage. Accelerators vary drastically in preferred startup developmental stages, from raw prototypes to early revenue. Determining current status and 12-18-month objectives allows targeting accelerators positioned to provide relevant support. Ventures farther along often gain little from basic programming.

Assessing Company Traction. Many accelerators have set thresholds for customer pipeline or revenue at admission to ensure participating ventures can viably absorb capital. Early funding without market validation risks investor blowback. Startups should objectively evaluate what accelerator traction expectations reveal about readiness.

Mapping Provider Expertise. The degree to which an accelerator provides domain specialization expertise should guide accelerator selection, be it hardware manufacturing, biotech clinical trials, or insuretech distribution. Alumni startup verticals indicate capital and mentor competencies. Niche accelerators can amplify resources in complex sectors.

Examining Terms and Incentives. Accelerator funding and equity terms also warrant scrutiny to determine alignment with startup goals and risk tolerance. Mainly, early-stage companies should evaluate if giving up equity makes sense. And the accelerator's economic incentives must prioritize startup success for productive partnerships.

For ventures debating the accelerator path, grasping specific performance milestones expected after graduation should steer decisions. Gained operational expertise plus investor and customer access may justify temporary equity and control concessions in exchange for multi-year productivity gains.

In summary, startup accelerators fill a crucial niche, bridging early traction to external fundraising through programming and unparalleled access outside elite graduate institutions. But understanding stranger incentives, realistically evaluating equity dilution, and confirming post-program support structures should steer founder decisions on whether temporary acceleration is appropriate for their startup's next inflection point.

The Power of Crowdsourcing for Startups

Introduction People frequently ask entrepreneurs how they come up with new ideas. This answer is not as straightforward as one might think. There are many ways that entrepreneurs and innovators come up with new ideas, products, and processes. It is only half the story even once you have a list of idea-generating sources. As it turns out, having new ideas is only the starting point. It takes a structured process of experimentation and iteration to turn new ideas into innovative outcomes. That said, it is worth looking at methods to generate new ideas that lead to innovative results. This post will focus on one specific form of sourcing new ideas and new ways of thinking about problems, namely crowdsourcing.

Crafting Startups In-House: Venture Studios

Venture studios flip the script on conventional business incubation models by internally building new startups. Also known as startup factories, studios combine specialized team capabilities, infrastructure, and access to capital under one roof to create, fund, and scale ventures based on targeted ideas. The hands-on approach trades inherent startup flexibility for implemented structure and processes from day one.

The venture studio model has seen exceptional growth in recent years. From the initial concept pioneered in 1996, over 720 startup studios now operate globally – with 334 added in the last two years. Accelerating momentum is evident as seasoned founders and investors increasingly embrace centralized, structured startup-building methods to solve problems around talent access, fundraising, and achieving product-market fit.

Defining Venture Studios and Their Approach

Venture studios, also known as startup studios or company builders, provide a distinctly different startup support model compared to incubators and accelerators. Rather than supporting external teams' ideas, venture studios build new companies internally from scratch. Studios source concepts and talent, fund initial development, and leverage shared resources to launch startups with maximum viability.

They tend to focus on early-stage ideas that could not otherwise raise external capital. With in-house teams handling technical, business, and fundraising elements, venture studios rapidly iterate to validate and scale working models. The hands-on, operations-heavy approach trades off flexibility for implementing structures quickly. Leading studios like Atomic and eFounders shape ideas into multiple portfolio startups across various sectors.

While definitions vary, standard venture studios seek over 50% equity in the spinout ventures they create, retaining control for strategy and funding decisions. The parent studio covers initial costs to prototype and commercialize ventures in exchange for significant future ownership. Studios also tap external investors when desiring to scale launches further, structuring rounds favorably given their controlling stakes. Portfolio churn is accepted, anticipating select outlier startup successes covering failed attempts and studio costs.

This integrated, focused approach can efficiently manufacture startups but requires careful founder due diligence given highly involved terms. Venture studios take the accelerator goal of systematically progressing ventures further through more intensive direction tradeoffs and financial interlinking.

Typical Studio Hosts and Structures

Most startup studios are backed by private capital - whether from independent investors, VC funds, corporations, or angels. These sponsors provide financing for operational and startup-building expenses across annually generated ventures. Objectives tend to center around financial returns and strategic technology access. However, some early examples of government-affiliated venture studios are still in limited cases. State-backed programs in countries like Canada and Brazil have launched studios focused on diversifying economies and commercializing research. These public studios receive funding to catalyze local innovation and high-quality jobs without near-term fiscal ROI requirements. They tend to offer broad-based assistance compared to private studios, which closely integrate startups to meet sponsor strategic priorities.

Regardless of funding sources, public and private venture studios leverage shared resources and expertise to efficiently build startups using standardized processes - owning majority equity stakes to embed financial and operational control.

Integrated Offerings and Expertise

With full-time specialized staff, venture studios offer broad and deep infrastructure spanning startup needs from raw concept to early customer traction:

On the technical front, product managers rapidly shape applications and data architectures for validation testing. Engineers build MVP prototypes leveraging reusable platform components like billing systems.

Business operators devise go-to-market plans, draft playbooks, and implement processes that enhance viability. Recruiters access talent networks to staff critical roles pre-launch quickly.

Domain experts tailor scientific, manufacturing, and company-building advice to the market verticals, increasing insight quality.

Marketing managers devise positioning and outbound campaigns to acquire target segments for product iteration efficiently. Data scientists embed analytics in decision-making.

Capital partners structure financial instruments and external financing rounds optimized to studio goals and startup stages. They also directly oversee budgeting and governance.

This breadth eliminates the need for founders to handle all the heavy lifting early on. Studios believe they can de-risk ideas by building in structured experimentation, talent, and oversight. Of course, the broad scope also introduces overhead and principal-agent tension without careful management.

But few organizations can encircle startups so comprehensively. Studios leverage offerings plus equity control to stack the odds of investing time and capital in the ideas and teams showing the most traction. The integrated support empowers launching startups rapidly but also requires significant founder buy-in.

Funding and Building Startups In-House

Given their hands-on startup-building model, venture studios require substantial upfront capital, investing $ 500 K- $ 2 M to incubate each raw venture concept. Studios are ultimately responsible for funding portfolio company operations, not just one-time seed capital. Sponsor backers like corporations, VCs, and angels provide core financing to subsidize the breadth of resources offered across annually generated startups.

Venture studios typically have a strong incentive to maintain control over their portfolio companies, allowing them to maximize their returns and ensure the attainment of their vision for the companies. By selling minority stakes to VCs and allocating the remaining equity to founders and internal staff, venture studios can achieve a balance of control and financial flexibility.

Such financial interlinking aligns incentives but limits founder independence. Tradeoffs emerge between studios nurturing ventures under one roof versus accelerators taking small equity positions in fairly spun-out startups. Negotiating terms around economics and governance is crucial for external founders entering studios backing pre-vetted ideas.

With portfolio volumes, venture studios anticipate selecting outlier startup valuations and exits to compensate for inevitable failures. This portfolio budgeting lets studios double down on ventures showing traction. The in-house launching pad can efficiently build enterprises, but hands-on support warrants analysis of motivations and control.

Evaluating Fit and Alignment with Studios

With venture studios taking an intensely hands-on role in building and nurturing startups in-house, assessing alignment warrants significant diligence. Critical aspects for founders to analyze include:

Defining Concept Stage. Studios often source ideas internally or require external pitches to meet strategic needs. Determining where a concept falls from raw hypothesis to validated customer requests steers suitable studio matching. Very early, unproven ideas likely fit studio experimental models more appropriately.

Assessing Operational Expertise. Founders should scrutinize studio leadership, staff expertise, partnerships, and performance launching ventures in targeted sectors to gauge infrastructure advantages offered. Wide-ranging technical, business development, and fundraising support can de-risk operational aspects, but overextended studios may underdeliver. Consistent alumni scaling successfully indicates thorough post-launch nurturing.

Examining Economics and Incentives. Proposed studio equity stakes and liquidation preferences should undergo meticulous evaluation against hands-on supporter value adds before accepting diluted ownership. Teams retaining the flexibility to raise external capital independently post-launch preserves options as ideas evolve. Mismatched incentives and inadequate funding runways pose downstream risks.

Re-Evaluating Direction Alignment. For any studio relationship, founders must continually re-assess if their priorities remain aligned as startups pivot from prototypes to commercialization. Periodic check-ins on strategy, funding, exit outlooks, and leadership vision help avoid surprises and unmet expectations.

While studios can efficiently manufacture investable startups, their broad scope warrants inquiry into motivations, resources, and value beyond capital. Investing time to uncover studio strengths and leadership commitments prevents partnership friction.

With their integrated resources and incentive alignments, venture studios can efficiently manufacture investable startups at scale as long as founders thoroughly vet proposed equity arrangements and post-launch control provisions. While still an emerging sector, studios expanding founder options for launching ideas warrant examination alongside incubators and accelerators as complementary in progressing startups from concepts to commercial viability.

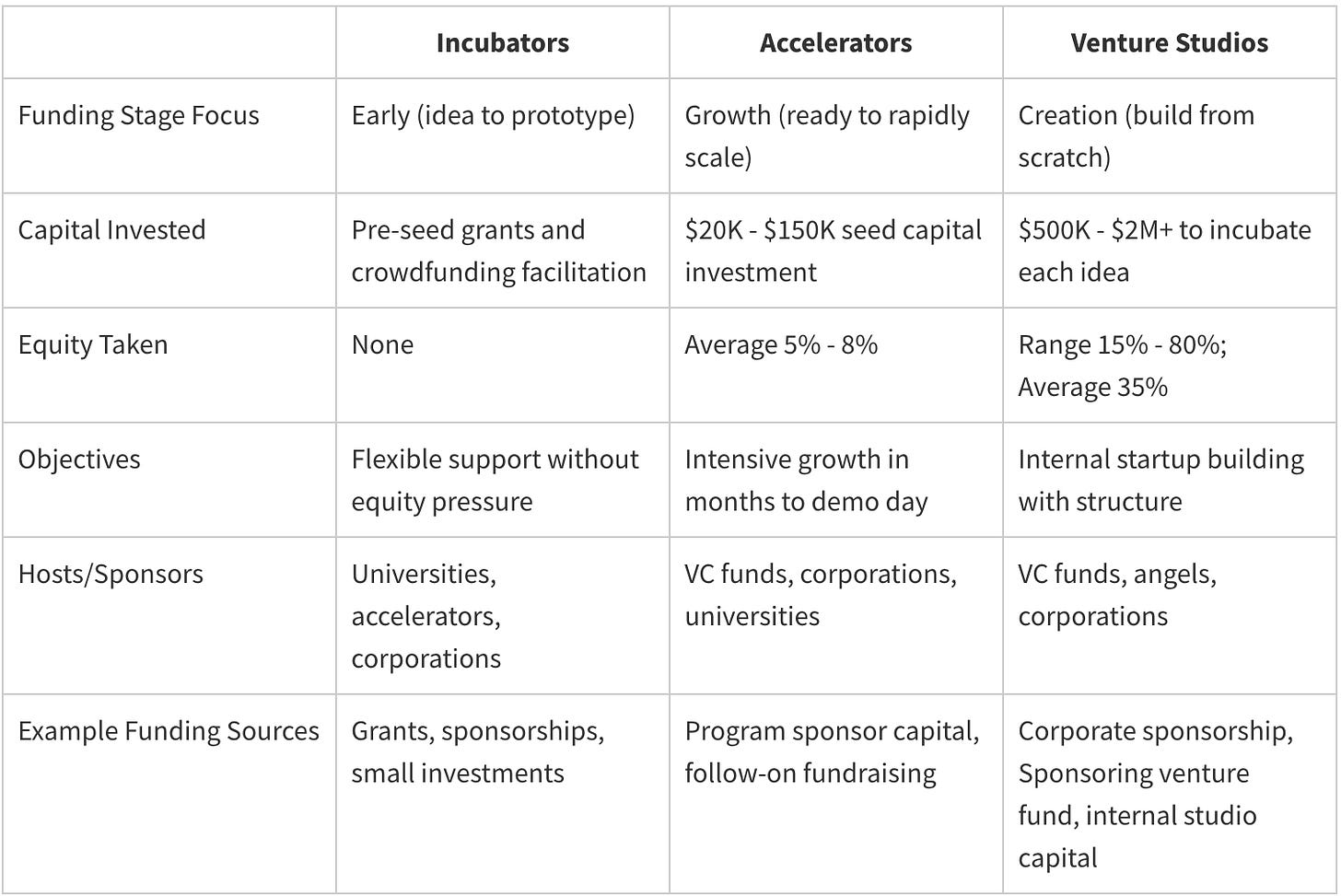

Comparative Table: Funding Distinctions Across Startup Support Models

Navigating the Best Acceleration Path

With incubators, accelerators, and studios playing interconnected roles across the startup journey, finding the one tailored to a venture's evolving needs is pivotal. Choosing partners who can adapt reaps the most significant rewards.

In navigating the ideal match, entrepreneurs should thoroughly examine four vital dimensions. First, candidly evaluate the current stage of development, from early viability testing to demonstrated customer traction to growth acceleration. Then, analyze organizational offerings through the lens of existing resource gaps and priorities. An incubator's flexible support resonant with variable emerging needs allows room to experiment. A structured studio environment amplifies assets needing more refinement than vision.

Additionally, scrutinize proposed funding profiles and equity involvement to quantify dilution tradeoffs relative to assistance value-adds. For their wide-ranging services, studios require majority ownership. Accelerators take smaller shares to supercharge momentum. Finally, research post-program alignment approaches to determine if intensive incubator mentorship suits short bursts of immersive advancement or if studios' ongoing direct involvement aligns better with execution capacities at this point.

Regular alignment re-assessments empower entrepreneurs to customize assistance matching emerging situation needs. Optimized bridges across models keep ventures fueled as concepts progress to customers. Mapping program incentives and oversight to risk tolerances at each turning point elevates ventures' odds of scaling efficiently.

Innovation at the Intersection: Startup-Corporate Partnerships

Introduction Innovation is essential for any business that wants to stay competitive and relevant in today's rapidly changing market. However, innovation is challenging, especially for large corporations facing bureaucracy, risk aversion, silos, and inertia. That's why many corporates are looking for ways to collaborate with startups, which are often more agile, creative, and disruptive.

Bridging the Non-Equity to Equity Funding Gap

Startup support models facilitate entrepreneurs’ progression from self-funding and grants to formal venture capital investment. Different programs align to needs at various development stages.

Incubators empower founders to establish initial viability without requiring equity relinquishment. By providing flexible workspaces, connections to pre-seed funding sources and grant programs, and assistance in developing sustainable business models, incubators help ventures achieve key milestones before seeking VC backing. Graduates gain enough validation to pique investor interest.

Accelerators trade equity for intensive growth stimuli, both financial and operational. Rigorous mentoring and network access aim to rapidly advance startups to VC-ready levels while demo days grant fundraising visibility. Managed seed capital also covers near-term expenditures. Equity sold funds to support the underlying sharp scaling.

Venture studios develop ventures internally rather than assume outside concepts, building management teams’ strategic objectives and returns into framework and incentives. Substantial funding enables robust resourcing to support ventures equipped for rapid launch and expansion. With controlling equity stakes, studios can aggressively advance ventures per predefined parameters.

Though models differ, properly timed program partnerships transform startups from fragile to fundable. Matching accessible business-building resources to current gaps and founder risk preferences allows non-dilutive launching before controlled acceleration.

New Directions Across the Startup Support Ecosystem

Several developments across startup assistance models share a common thread – democratizing broader access to value-added programming by innovating on reach, funding, and areas of focus. From tapping new technologies to alternative financing to amplifying impact, fundamental shifts across incubators, accelerators, and studios aim to empower more entrepreneurs globally.

Virtual Programming

The COVID-19 pandemic necessitated a shift to remote operations for most startup assistance programs over 2020-2022. While largely successful given the digital-first nature of participants, virtual formats limit certain benefits like face-to-face collisions and hands-on workspace sharing. As virus concerns ease, providers integrate lessons like wider accessibility with renewed physical gathering. For example, many accelerators now leverage hybrid in-person/virtual curricula, balancing collaboration and expanded reach - increasing inclusion through technology. Blended models striking engagement/efficiency balances prevail.

Alternative Funding Growth

Beyond traditional VC and angel sources, startups tap growing alternative funding pools like crowdfunding, micro-VCs, and revenue-based financing to cover near-term expenditures as needed. Incubators and accelerators guide founders in navigating the widening options for early capital apart from equity stakes while providing grant application assistance. For instance, some accelerators now facilitate founder access to micro-investor networks interested in small crowdfunded stakes rather than board seats – opening access through innovation. Expanded non-dilutive runways allow more experimentation flexibility by opening access.

Mission Focus Increasing

Social entrepreneurship addressing needs like affordable quality healthcare/education, environmental sustainability, and economic inclusion gains prominence. A subset of impact-focused incubators, accelerators, and studios cater to mission-driven ventures through aligned mentor networks and customer/funder access. For example, many now conduct ESG alignment audits to match startups to programs showcasing social impact metrics prominently – extending impact opportunities. Mainstream programs also increasingly tout ESG metrics and social consciousness.

Global Participation Rising

Top accelerators recently boast 40%+ global startup participation as virtual formats increased applicant access worldwide. Broadened geographic scope connects new ecosystems while diversifying perspectives. For instance, some corporations now fund local alliance managers to build regional startup talent pipelines and ease the international expansion of their studio portfolio companies – enabling efficient, broader tech transfer and knowledge exchange. As digital transformation permeates globally, assistance providers enable efficient, wider tech transfer.

Conclusion

Startups face distinct funding challenges as they progress from fragile ideas to growth-stage enterprises. Incubators, accelerators, and venture studios are complementary in bridging viability to venture capital across this journey. Tailoring programming and incentives to close current gaps while reconciling founder priorities elevates success odds. Bridges across models align assistance to needs at each turning point. As ventures traverse the startup lifecycle, periodically reassessing changing objectives against support resources offered enables entrepreneurs to recalibrate assistance for optimal impact at each phase. The expanding menu of startup support combined with intentional matching helps founders remain optimally fueled. Choosing partners who can adapt reaps the most significant rewards. Surrounding ideas with the right resources unlocks their fullest potential.

Keep reading with a 7-day free trial

Subscribe to Innovate & Thrive to keep reading this post and get 7 days of free access to the full post archives.